Venus takes a swim, Mars catches Fire

Week beginning September 8, 2014

This will be an interesting week in the markets in spite of the ceasefire negotiated to bring Ukraine off the boil.

Copyright: Randall Ashbourne - 2011-2014

And Clif Droke, who is both an expert in Kress cycles and financial astrology, is forecasting a decline into October or, at best, a continuation of a sideways range.

Both of them believe there will be a strong resumption of the Bull trend in the later part of the year.

This week begins with a Harvest Full Moon. Mercury will square Pluto and oppose Uranus; Venus will oppose Neptune midweek; and Mars moves out of Scorpio into the Fire sign, Sagittarius, next weekend.

Normally, the Full Moon is a statistical low point. It might not work this time.

Both of them believe there will be a strong resumption of the Bull trend in the later part of the year.

This week begins with a Harvest Full Moon. Mercury will square Pluto and oppose Uranus; Venus will oppose Neptune midweek; and Mars moves out of Scorpio into the Fire sign, Sagittarius, next weekend.

Normally, the Full Moon is a statistical low point. It might not work this time.

I indicated last weekend that Wall Street was likely to be volatile in the shortened week following the Labor Day holiday and we'll look at exactly how that panned out in a moment.

There is the potential for danger dead ahead. One of the most accurate Elliott Wave theorists on the web believes American markets are about to go into correction.

There is the potential for danger dead ahead. One of the most accurate Elliott Wave theorists on the web believes American markets are about to go into correction.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

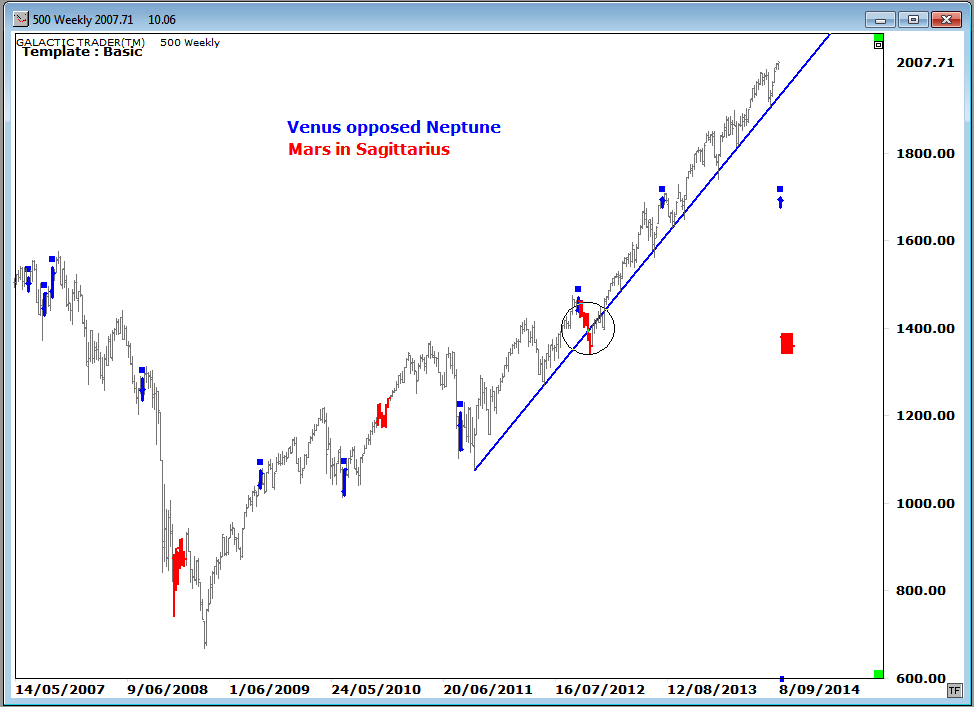

Let's look first at the historical track record of Venus opposing Neptune and Mars entering Sagittarius. In terms of Greek mythology, Venus and Neptune are buddies.

Venus was born when Saturn castrated his poppa, Uranus, and threw his manly bits into the ocean. There was a bit of froth and bubble, Venus popped up, and Neppy rescued her from the waves and took her back to shore in his chariot.

So, aspects between Venus and Neptune have a tendency to be relatively benign. The reality doesn't always match the expectations; Venus-Neptune oppositions occur near peaks, as well as troughs. There has been only one previous occasion in the past few years where the aspect occurred simultaneously with Mars moving to Sadge ... it concided with the sudden drop in October, 2012.

Venus was born when Saturn castrated his poppa, Uranus, and threw his manly bits into the ocean. There was a bit of froth and bubble, Venus popped up, and Neppy rescued her from the waves and took her back to shore in his chariot.

So, aspects between Venus and Neptune have a tendency to be relatively benign. The reality doesn't always match the expectations; Venus-Neptune oppositions occur near peaks, as well as troughs. There has been only one previous occasion in the past few years where the aspect occurred simultaneously with Mars moving to Sadge ... it concided with the sudden drop in October, 2012.

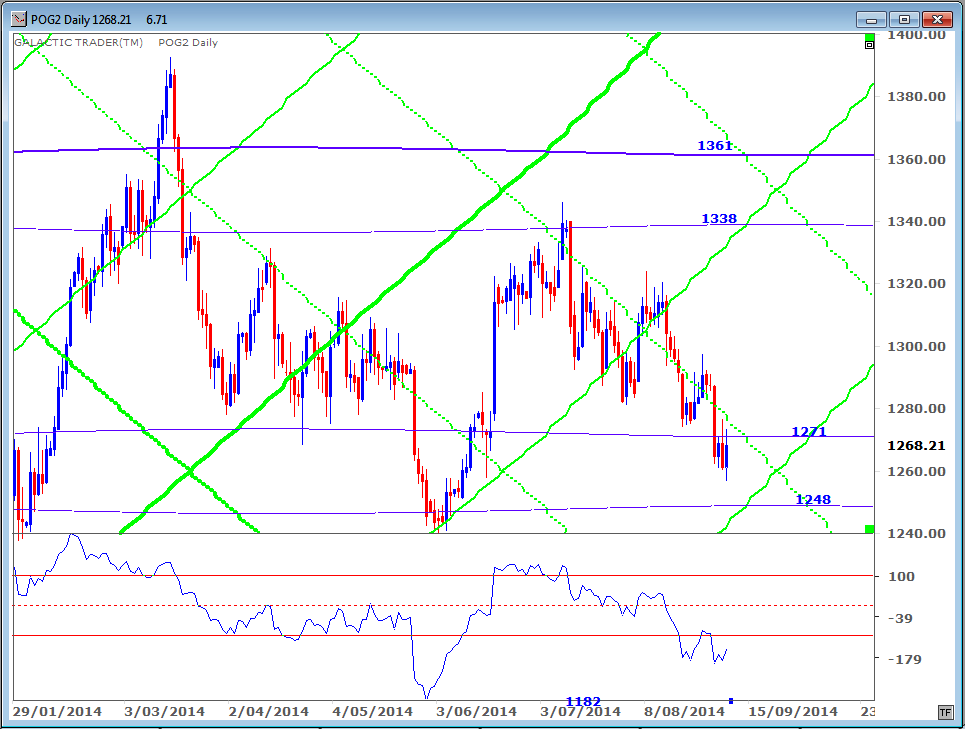

That battle is perhaps even more obvious when we return to the wider view of where Pollyanna is positioned in relation to primary planet prices. Breakout above the falling, dark green Venus opens targets at 2028 and rising Mars in the 2040s; a breakdown suggests the 1970s or 1960 before strong support comes back into play.

The ASX 200 is still having trouble climbing above, and staying above, its Weekly Planets Neptune barrier, now priced around 5640.

The rise in the value of the American dollar caused another sharp slump in the price of greenback gold. There is potential support from a secondary Pluto and a rising Sun line not far below.

Now, last weekend I indicated there was some danger to the SP500 rally because it had peaked the week before very close to the price of a Sun-Neptune crossing.

I said: "So, when Wall Street opens on Tuesday, the big boys' computers are going to have to force a gap above $2004 ... or the index will be in danger of starting a dive."

That is exactly what happened. Pollyanna gapped-up to open at almost $2006 when Wall Street went back to work on Tuesday.

And it gapped-up again the next day.

You can see just how volatile the shortened week was by the range of the price bars.

That's probably just a small taste of what is to come over the next few weeks.

There is a battle going on to control the immediate future of stock prices.

I said: "So, when Wall Street opens on Tuesday, the big boys' computers are going to have to force a gap above $2004 ... or the index will be in danger of starting a dive."

That is exactly what happened. Pollyanna gapped-up to open at almost $2006 when Wall Street went back to work on Tuesday.

And it gapped-up again the next day.

You can see just how volatile the shortened week was by the range of the price bars.

That's probably just a small taste of what is to come over the next few weeks.

There is a battle going on to control the immediate future of stock prices.