Elephant poop on a ragged Bear rug!

Week beginning September 17, 2012

Are we there yet? That's the question on everyone's lips after Uncle Ben surprised most of us with an open-ended QE3.

Copyright: Randall Ashbourne - 2011-2012

Based purely on what is "normal" for the latter, the answer to the question is: No!

But we may have reached a stalling point. Markets have a statistical tendency to decline between the New Moon and the next Full Moon and the coming week has some negative astrological aspects which may impact on further gains.

Pluto resumes Direct motion; we have the second exact instance of Uranus square Pluto; and late in the coming week, the messenger of the Old Gods, Mercury, will bring news related to the symbolism of that aspect by squaring Pluto and opposing Uranus.

But. As longer-term readers will know, I've been worried most of the year by "the elephant in the room" - the total lack of negative divergence in the long-range Canary oscillator (the 50CCI). We'll have a close look this weekend.

But we may have reached a stalling point. Markets have a statistical tendency to decline between the New Moon and the next Full Moon and the coming week has some negative astrological aspects which may impact on further gains.

Pluto resumes Direct motion; we have the second exact instance of Uranus square Pluto; and late in the coming week, the messenger of the Old Gods, Mercury, will bring news related to the symbolism of that aspect by squaring Pluto and opposing Uranus.

But. As longer-term readers will know, I've been worried most of the year by "the elephant in the room" - the total lack of negative divergence in the long-range Canary oscillator (the 50CCI). We'll have a close look this weekend.

The decision sent most world markets on a rocket ride to new highs - right into the statistical high of a New Moon and what I described last weekend as the "potential positive" of a Venus trine Uranus aspect.

We'll spend some time this weekend trying to divine the answer from the omens of the planetary charts and the technical conditions.

We'll spend some time this weekend trying to divine the answer from the omens of the planetary charts and the technical conditions.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

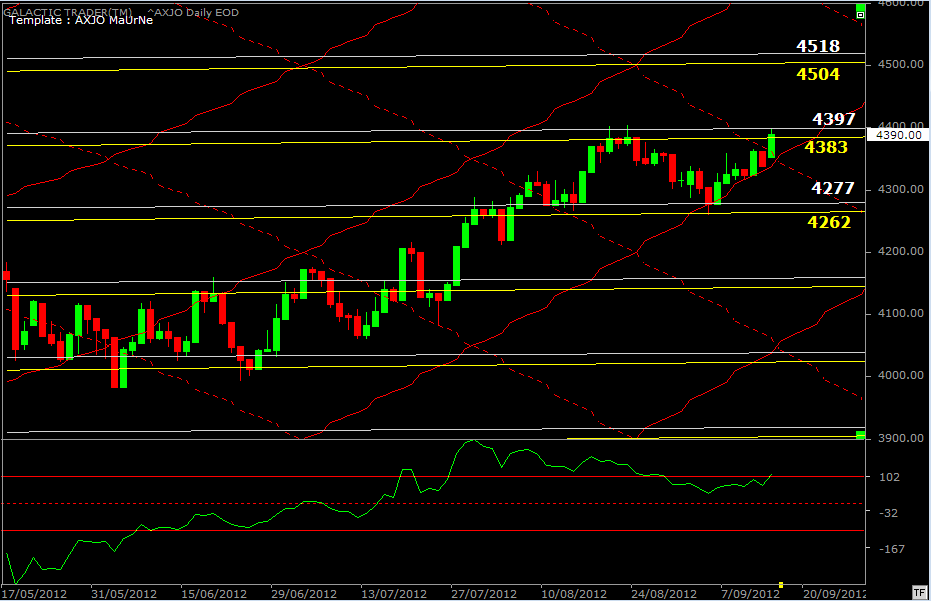

So, both of these indices behaved in a normal way in terms of these planetary charts ... hitting, or slightly overshooting, the target level before backing away to finish the week slightly under the levels. We'll review the position of other indices in a little while.

But the theme of this week - in an attempt to answer the question - will be to look closely at the long-range Canary to see if that damn elephant is going to continue pooping all over my now very ragged looking Bear rug!

But the theme of this week - in an attempt to answer the question - will be to look closely at the long-range Canary to see if that damn elephant is going to continue pooping all over my now very ragged looking Bear rug!

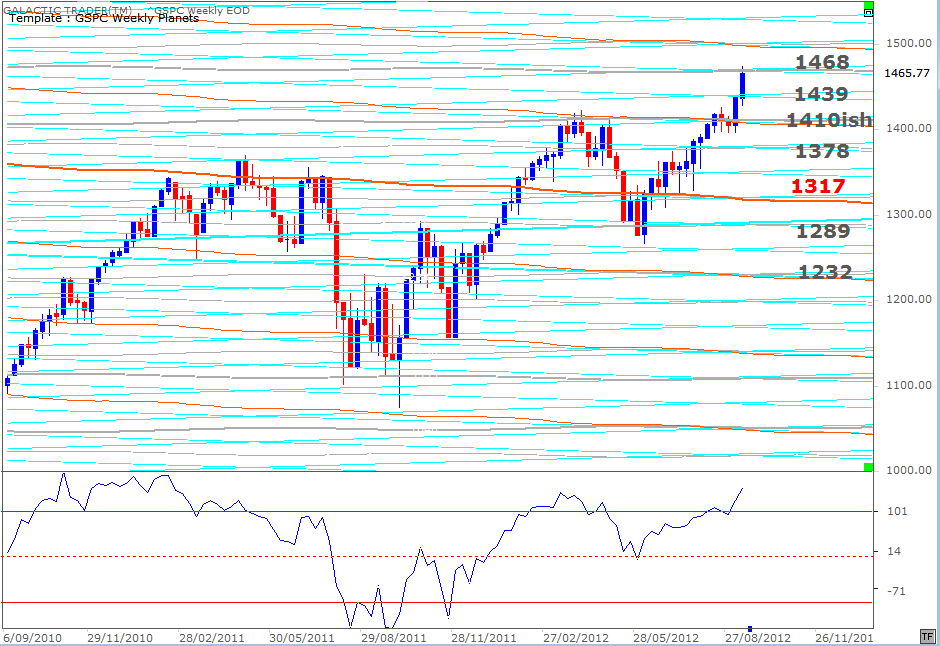

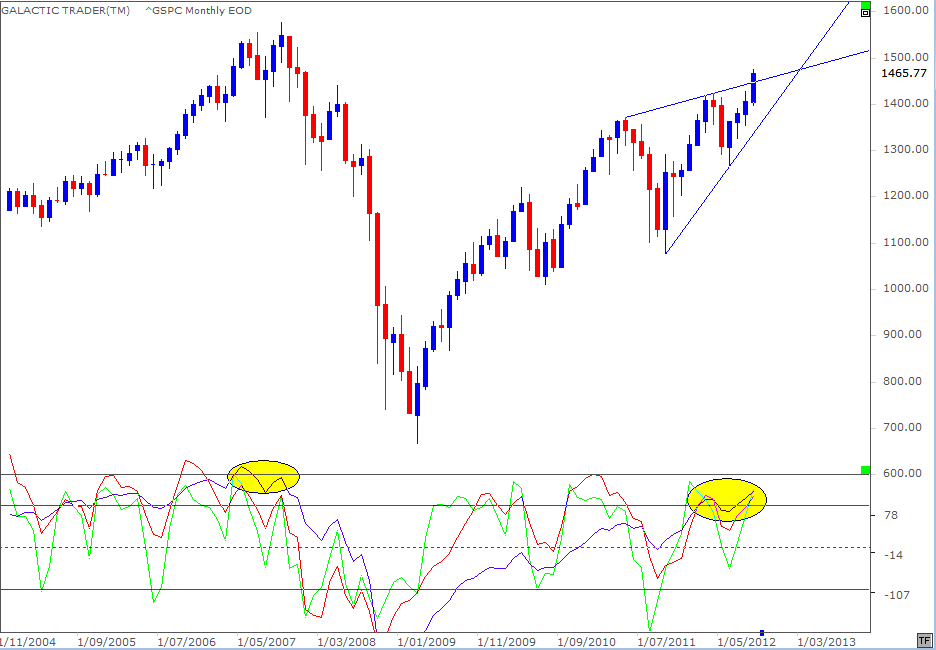

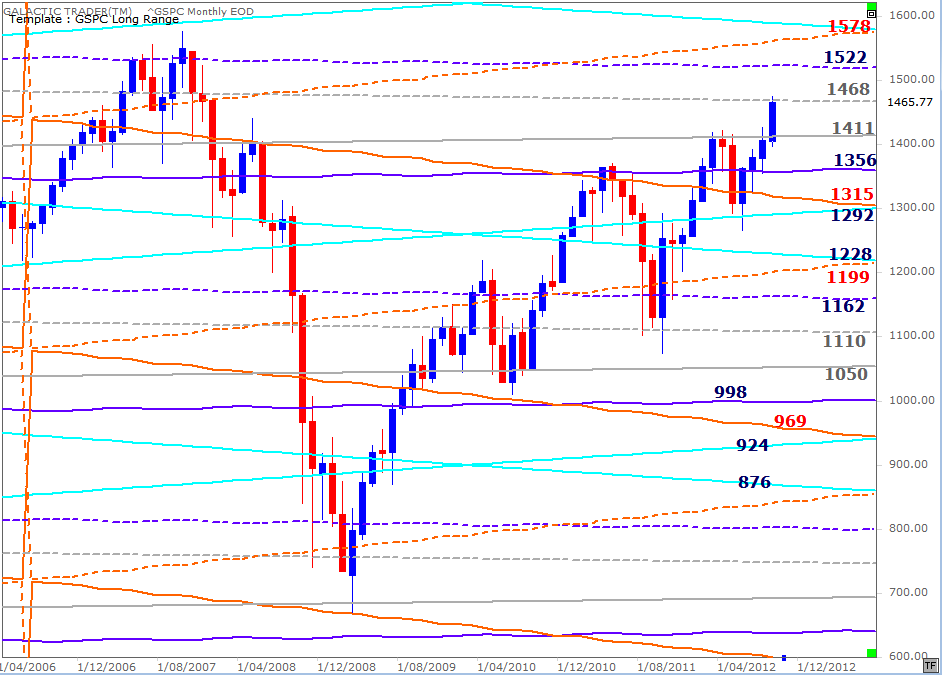

A few weeks ago, I showed this monthly chart of the 500, indicating the index seemed to be making what is called an Ending Diagonal pattern. A final overshoot outside the lines of the wedge is not unusual for an ED pattern.

The problem, as I still see it, is that there is NO negative divergence in the 50 CCI. I've marked the state of the oscillator at the 2007 topping process with a yellow oval. The Bear did not emerge until there was a clear divergence ... a lower peak in the Canary, while price made a new (and final) high.

Now, clearly there is no divergence current in the oscillator at this time. In fact, the higher peak in the blue line endorses the legitimacy of the rally, regardless of what we might think of Benzedrine and SuperMario stimulus.

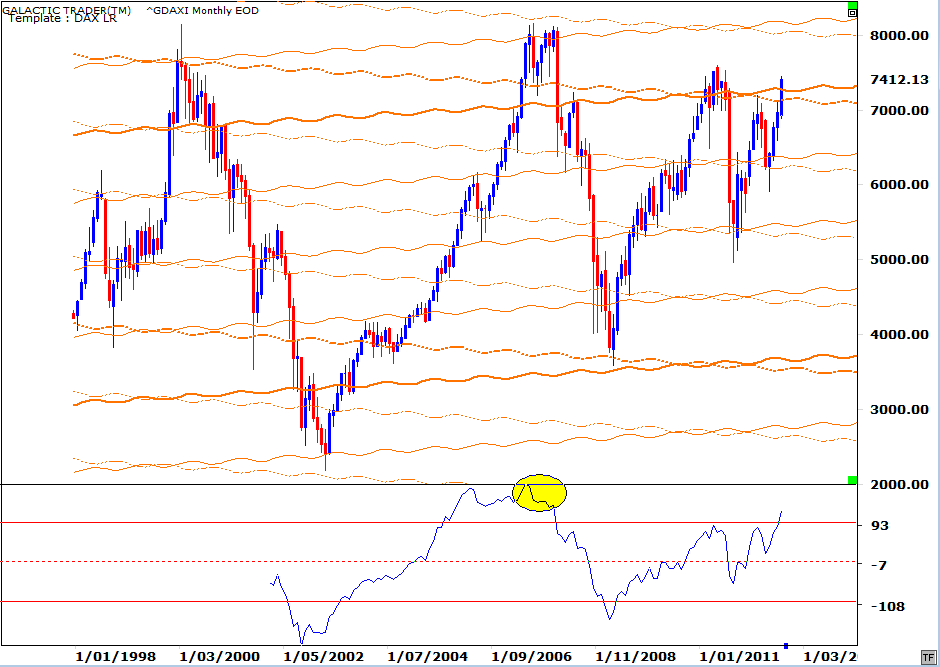

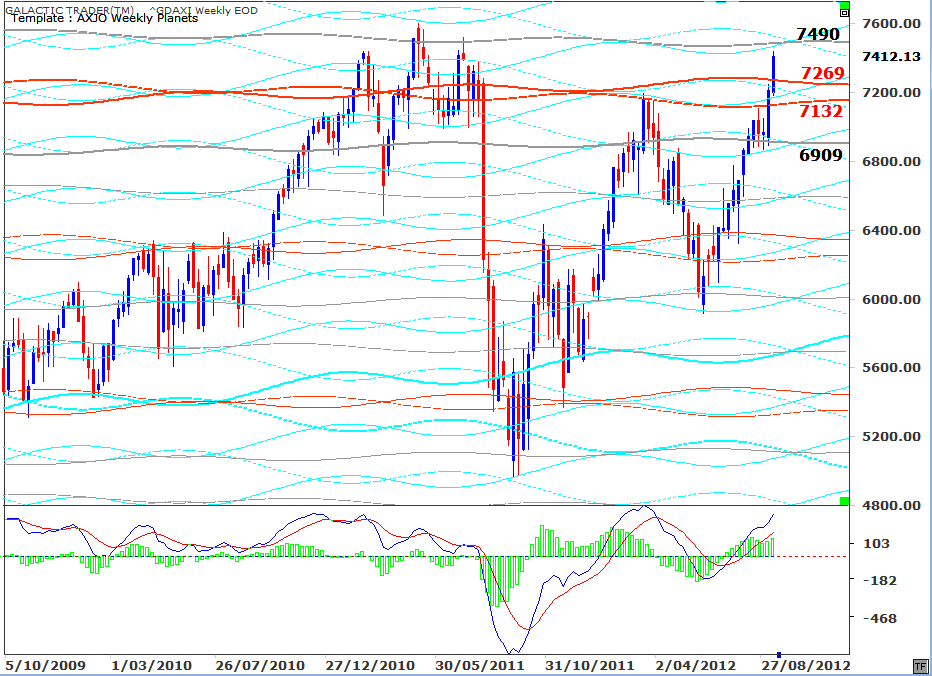

And the Canary's sweet-singing approval is also obvious in Germany's DAX.

The problem, as I still see it, is that there is NO negative divergence in the 50 CCI. I've marked the state of the oscillator at the 2007 topping process with a yellow oval. The Bear did not emerge until there was a clear divergence ... a lower peak in the Canary, while price made a new (and final) high.

Now, clearly there is no divergence current in the oscillator at this time. In fact, the higher peak in the blue line endorses the legitimacy of the rally, regardless of what we might think of Benzedrine and SuperMario stimulus.

And the Canary's sweet-singing approval is also obvious in Germany's DAX.

For the past few weeks, we've been looking at potential upside targets in various indices and I'm sure some of my Old Gods charts have shocked a few technical readers who don't really want to "believe" the position of the planets, translated to price, sets reliable targets.

Again I point out the very obvious divergence displayed at the 2007 topping process ... a divergence that is very obviously NOT present at current price levels.

So, until the bird starts to sing off-key, we need to stay open to the idea that there are higher targets which will probably be hit.

So, until the bird starts to sing off-key, we need to stay open to the idea that there are higher targets which will probably be hit.

And yet, here we go - again. 1468 was set as the target last week for any further rally and Pollyanna, the SP500, obliged with an overshoot to 1474 before settling into a Close of 1465.

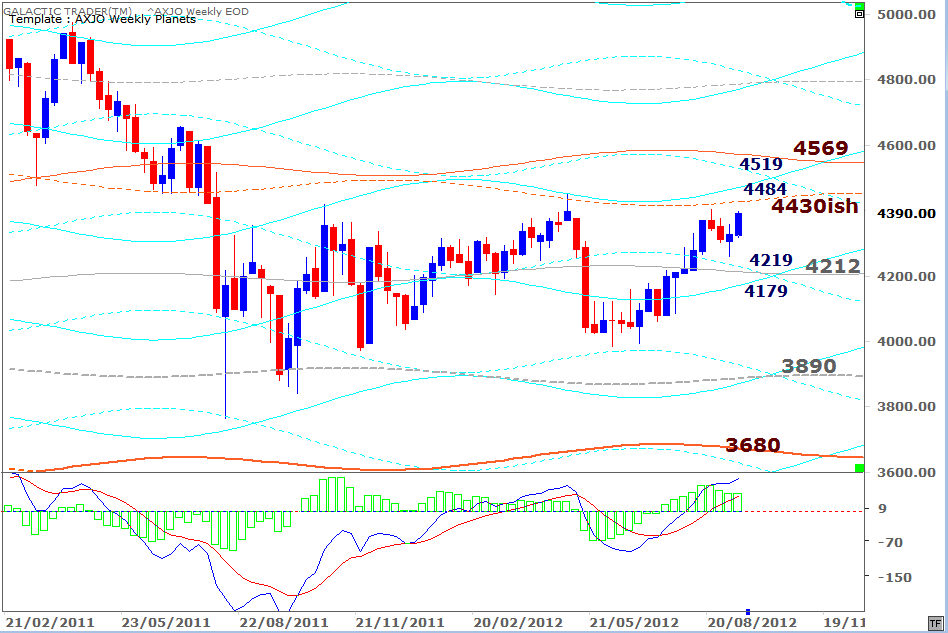

I introduced you to one of my private ASX200 charts in the past couple of weeks.

And ...

I introduced you to one of my private ASX200 charts in the past couple of weeks.

And ...

The Neptune line Miss Polly hit last week is an important one ... especially since it was a lower version of this planet which put a stop to the drop in August/September/October of last year. You'll also note the months of stalling at the unbroken Neptune line at 1411. It's worth tracing both the 1411 and 1468 lines back to see their impact during the 2007 topping process in this index.

Still, the Pluto line at 1522, or the Node at 1578, may be the final targets for this Bull run - and we need to continue watching closely to see if divergence appears in the oscillator should the index hit either of those levels.

Now, remembering there is no divergence in the DAX long-range Uranus chart above, it would be unusual for that index to not hit its upside Weekly Planets targets. Not necessarily immediately, but certainly before we can be certain that "we're there yet".

Still, the Pluto line at 1522, or the Node at 1578, may be the final targets for this Bull run - and we need to continue watching closely to see if divergence appears in the oscillator should the index hit either of those levels.

Now, remembering there is no divergence in the DAX long-range Uranus chart above, it would be unusual for that index to not hit its upside Weekly Planets targets. Not necessarily immediately, but certainly before we can be certain that "we're there yet".

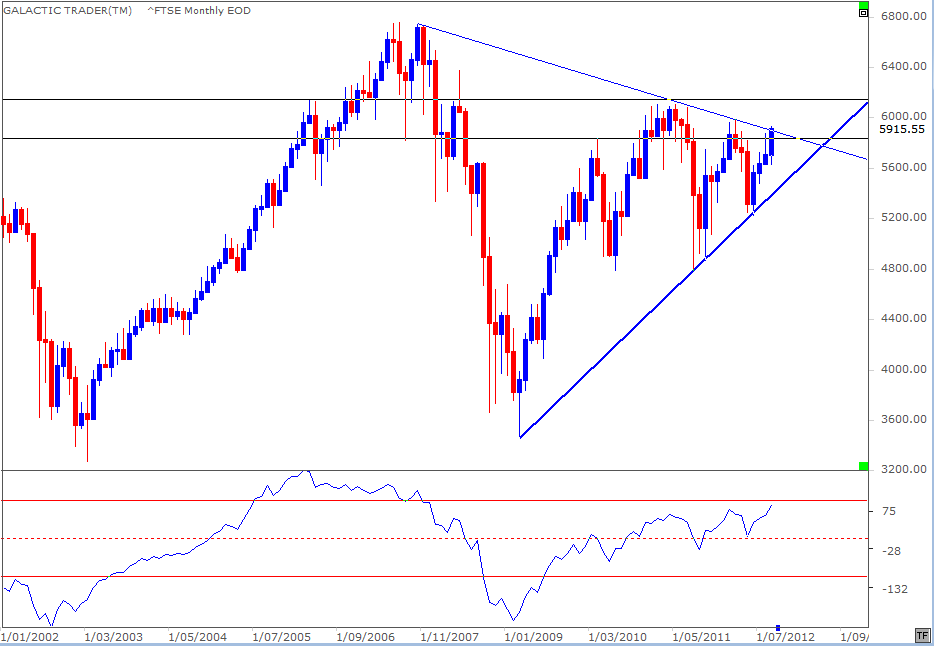

Again, there is a long build-up of divergence as the FTSE went into its 2007 peak ... and there is currently nothing but positive confirmation from the oscillator. In fact, we have the reverse position. The oscillator is indicating that price is dragging its heels and has higher to run.

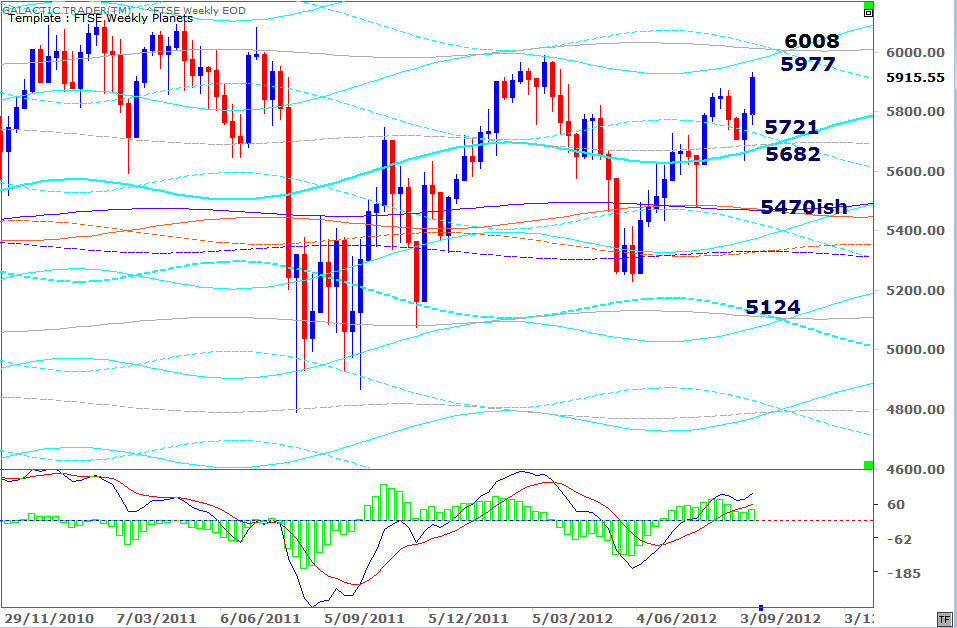

I published a long-range planetary chart for the index last weekend and you can have a look in the Archives; below is the FTSE's Weekly Planets chart for the intermediate moves.

I published a long-range planetary chart for the index last weekend and you can have a look in the Archives; below is the FTSE's Weekly Planets chart for the intermediate moves.

There is one FTSE chart which indicates a correction may be about to begin.

Let's have a look now at London's FTSE. Showing the following chart last weekend, I said: "A long-range technical chart for the index shows price obeying the confines of a triangle, jumping from the uptrend line and stalling at the downtrend angle. As price gets forced into the business end, it will have to breakout, or break down. The reason I cannot rule out the former is the state of the long-range Canary, which is recording higher peaks even though price has not done so. There are a couple of horizontal technical levels which have "history" and are worth watching closely."

I mentioned the New Moon and the Venus trine Uranus aspect last weekend as Spooky Stuff positives. Friday's big gap-up took the index to a precise meeting with the Venus/Uranus price crossing point. It's difficult to know how much weight to give that since the aspect took place on Thursday, not on Friday.

If the index had closed above the exact price crossing point, higher prices immediately would be virtually assured. But failure to breach the level is a potential warning sign of lower prices just ahead.

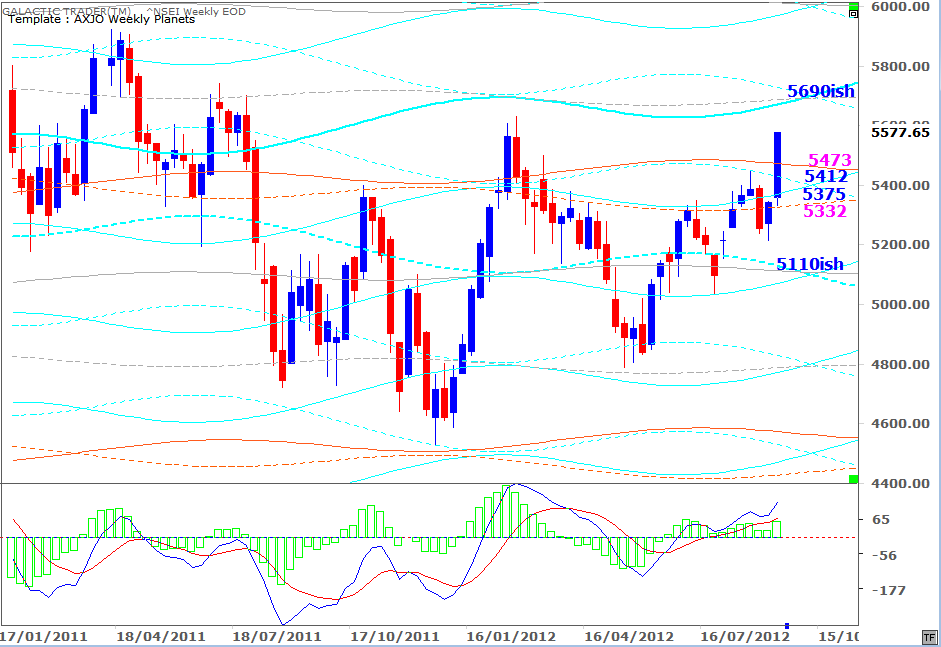

Below is the Nifty 50's Weekly Planet charts with updated targets.

If the index had closed above the exact price crossing point, higher prices immediately would be virtually assured. But failure to breach the level is a potential warning sign of lower prices just ahead.

Below is the Nifty 50's Weekly Planet charts with updated targets.

And, finally, we'll go to my home index, the ASX200. If you want to go back to the private chart I showed earlier, you'll see I've added the next level of upside targets. I explained the basis for this chart over the past couple of weeks, so check the Archives. Auntie's Weekly Planets targets are listed below.

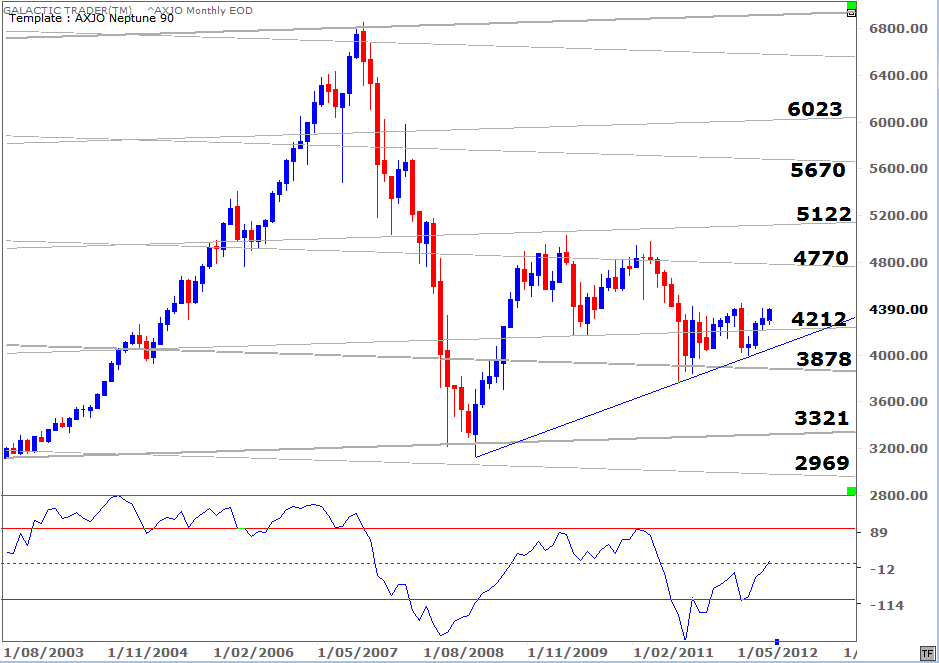

And since I've published long-range planetary targets for Pollyanna, the FTSE and the DAX over the past few weeks, here's the big picture possibilities for the 200, a Neptunian index.

The logical side of my brain thinks the 4770 target is impossible. The higher peak at lower price state of the Canary seems to think my brain doesn't actually have a logical side!

The logical side of my brain thinks the 4770 target is impossible. The higher peak at lower price state of the Canary seems to think my brain doesn't actually have a logical side!

So, there you have it. Some indices have hit important planetary targets fairly precisely - and did it when the lunar phase and astro aspects were in a very, very good mood. The astrological weather now has storm warnings with Mercury (news) at odds with the huge negative potential of another exact Uranus/Pluto hit this coming week.

But, the Big Bird thinks that while Price may be getting damn close to its final peak in some indices for this Bull run, Time may not yet be ready to comply.

But, the Big Bird thinks that while Price may be getting damn close to its final peak in some indices for this Bull run, Time may not yet be ready to comply.