Reviewing long-range Old Gods targets

Week beginning September 10, 2012

We will spend some time this weekend reviewing the long-range planetary targets for a number of major world stock indices.

Copyright: Randall Ashbourne - 2011-2012

Since the peak of the jump coincided with a Sun square Jupiter aspect, there's a chance things will stall and fall from this point - especially with some indices hitting the recent targets outlined in Weekly Planets charts over the past few weeks.

However, with a New Moon on the schedule for the coming week, as well as the potential positive of a Venus trine Uranus aspect affecting the near-term outlook, there is no guarantee the "good times" won't continue to roll.

American markets, particularly, seem to be following the usual pattern for Presidential election years, which would mean any significant drop in stock prices won't occur until after voting - and probably not until next year.

That's why we'll take a look at the long-range Old Gods charts, since they specify the probable targets without our needing to worry too much about the news.

However, with a New Moon on the schedule for the coming week, as well as the potential positive of a Venus trine Uranus aspect affecting the near-term outlook, there is no guarantee the "good times" won't continue to roll.

American markets, particularly, seem to be following the usual pattern for Presidential election years, which would mean any significant drop in stock prices won't occur until after voting - and probably not until next year.

That's why we'll take a look at the long-range Old Gods charts, since they specify the probable targets without our needing to worry too much about the news.

Most markets popped dramatically last week after the stimulus shot from Super Mario, and Wall Street interpreted bad jobs numbers as boosting the chances of another dose of Ben-zedrine.

But the Draghi impact was patchy; some markets popped to new Highs while others continue to drag their heels.

But the Draghi impact was patchy; some markets popped to new Highs while others continue to drag their heels.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

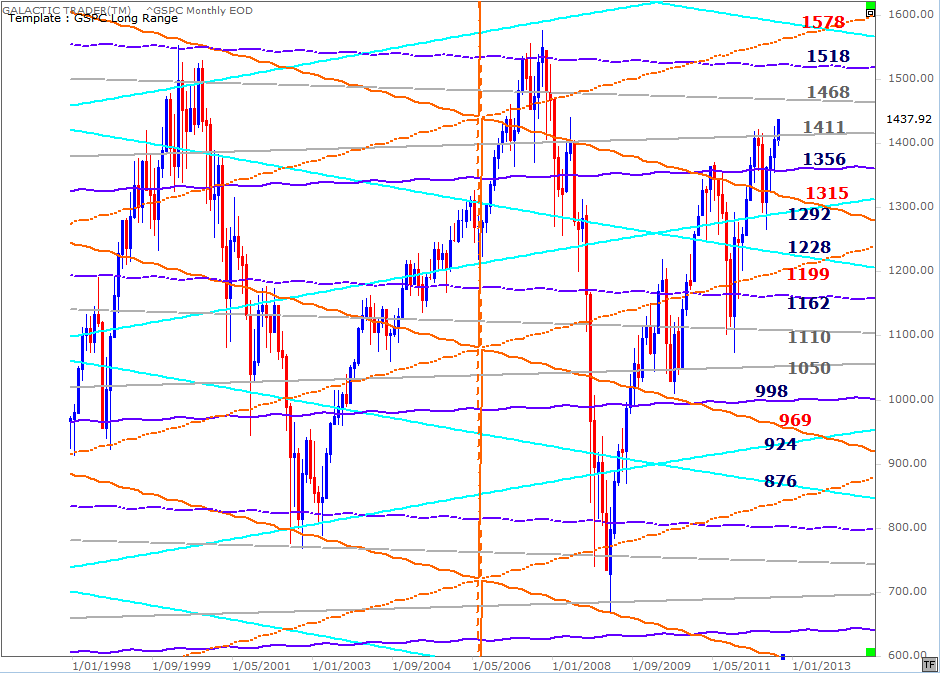

The two previous all-time Highs in this index were capped by contact with a Pluto line, currently priced at 1518. An overshoot of that could take Miss Polly all the way to 1578.

Either target would present a multi-decade triple-top formation and the downside becomes disastrous - especially if all the trillion-dollar bail-outs do is prop up bad bank behaviour and Wall Street, while ignoring the real economy of what the Americans call "Main Street".

So, with the SP500, price has reached an intermediate level important on the Weekly Planets charts and has 3 obvious planetary targets above that level.

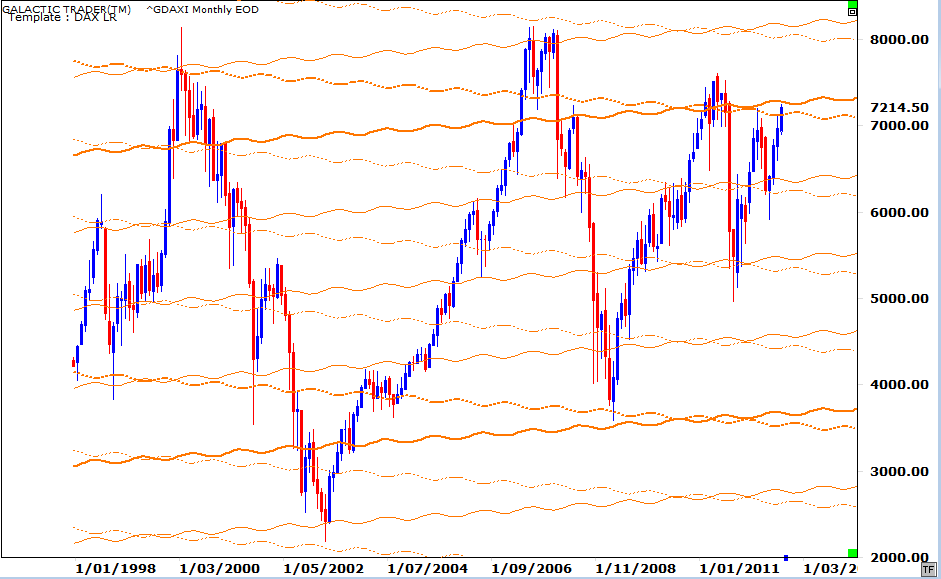

Not so with Germany's DAX. I published this chart recently to show the long-range impact of Uranus price lines and suggested the index was aiming for another hit of that price zone ... accomplished last week when the market liked what Mario offered, even if the Bundesbank didn't.

Either target would present a multi-decade triple-top formation and the downside becomes disastrous - especially if all the trillion-dollar bail-outs do is prop up bad bank behaviour and Wall Street, while ignoring the real economy of what the Americans call "Main Street".

So, with the SP500, price has reached an intermediate level important on the Weekly Planets charts and has 3 obvious planetary targets above that level.

Not so with Germany's DAX. I published this chart recently to show the long-range impact of Uranus price lines and suggested the index was aiming for another hit of that price zone ... accomplished last week when the market liked what Mario offered, even if the Bundesbank didn't.

Germany's Constitutional Court is a potential fly in the ECB ointment this coming week when it's due to rule on the validity of bailing out the Med countries with German savings. Regardless of that, the Dax Weekly Planets chart indicates a potential target in the 7490s, if there's a breakout above the long-range Uranus lines, the first of which has now been overcome.

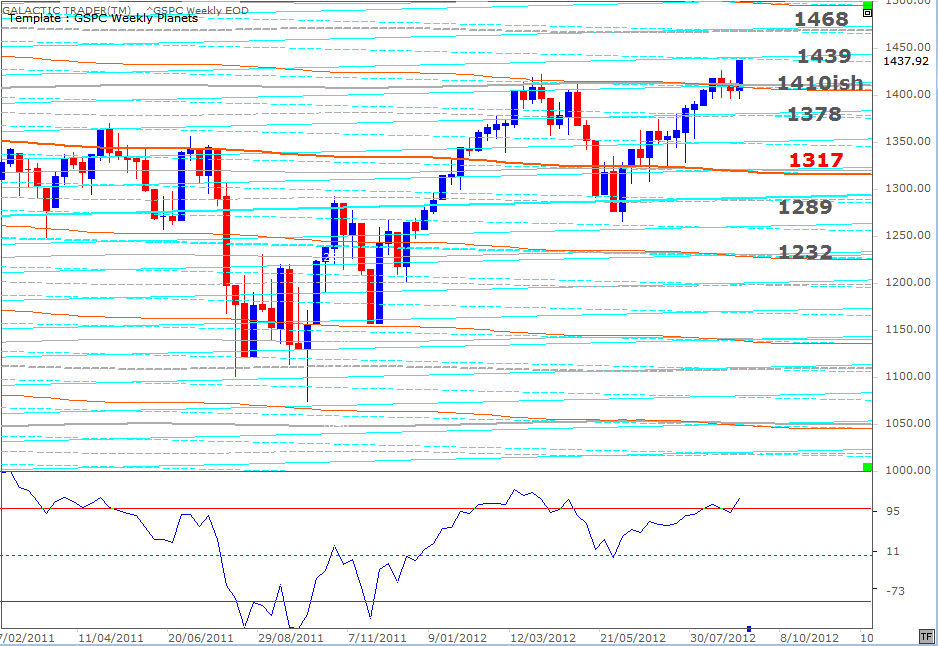

Last weekend, I published both the Weekly Planets and Long Range Planets charts for Pollyanna, the SP500, along with a weekly Bi-BB chart showing the upper boundary for the week at 1438.79.

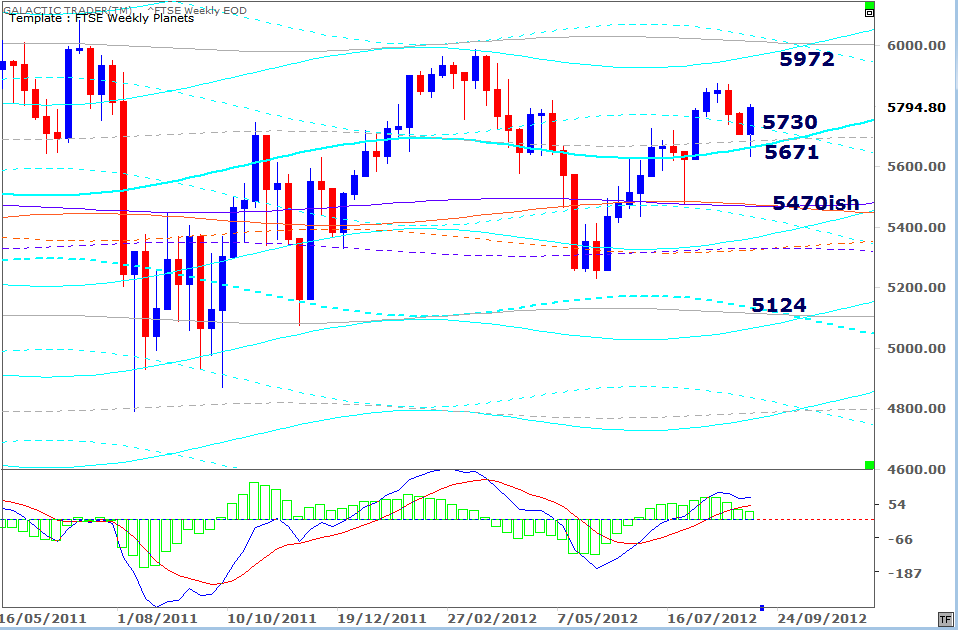

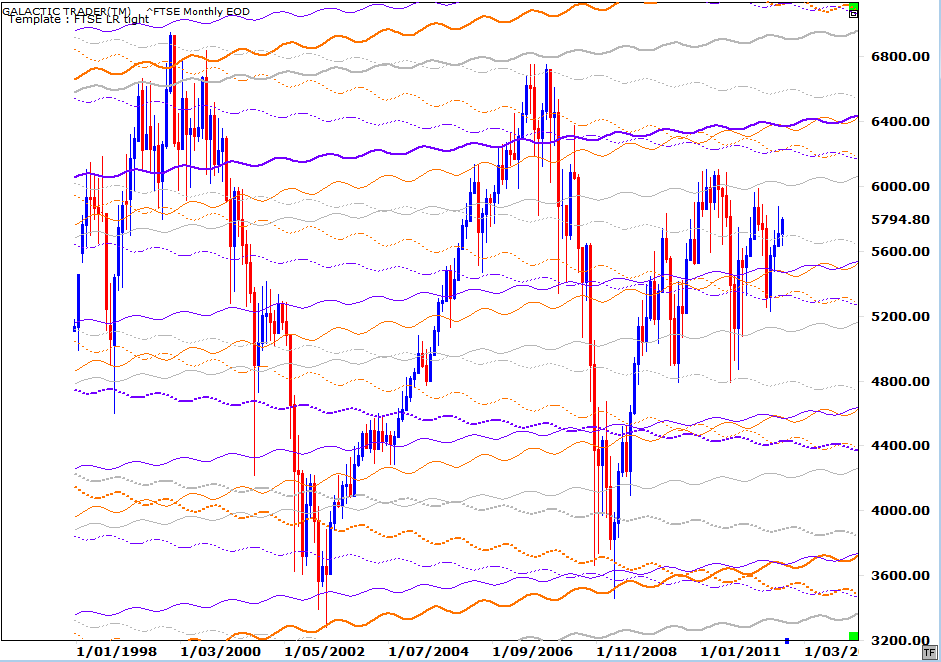

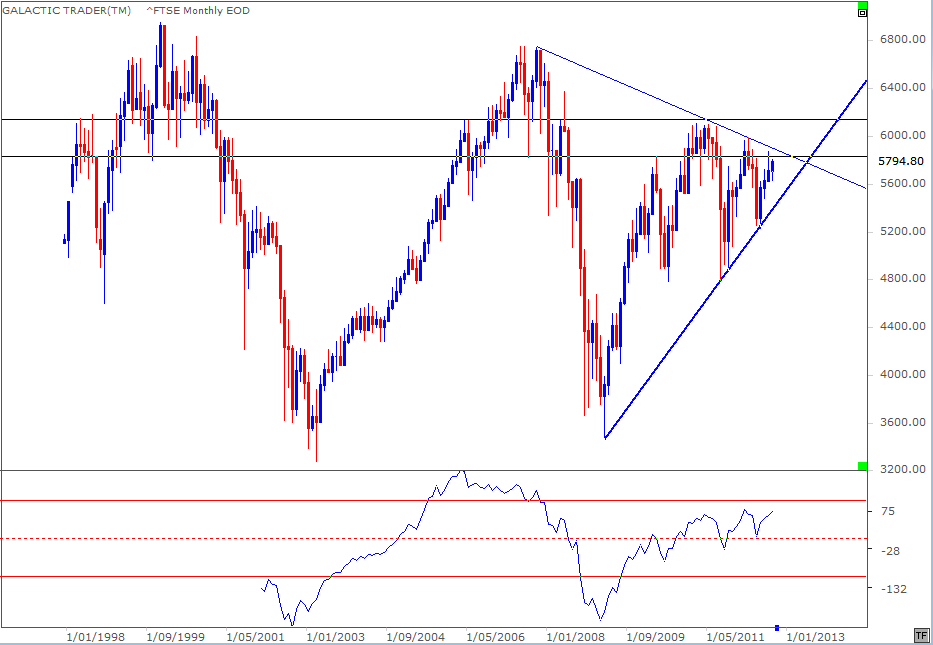

For quite some time now we've been using rising and falling Sun lines on London's FTSE index to get a read on what would happen with markets generally. I'll skip those charts this weekend and concentrate on the long-range position of most indices. However, you might recall that last weekend, I indicated it would take some bad news to keep the FTSE under the influence of the falling Sun-Mercury lines.

Polly's Weekly Planets chart also had 1439 marked as at least an interim target, should there be a breakout from the stalling level around 1410. The index hit a multi-year High of 1437.92 on Friday, only a whisker off the WP and Bi-BB targets.

Now, just in case this rally is to continue towards the November elections, I have updated the higher price targets on the 500's long-range chart.

Now, just in case this rally is to continue towards the November elections, I have updated the higher price targets on the 500's long-range chart.

As with the other indices, the Mario bounce was strong after the FTSE made a false break of the Saturn level shown last week as 5664. It's worth making a mental note that the FTSE did NOT break above the earlier highs, unlike the 500 and the DAX. That puts into question whether the FTSE has enough oomph behind it to reach the next target levels.

Those levels are around 6000 - and there is no difference between the FTSE Weekly Planets and its long-range chart.

Those levels are around 6000 - and there is no difference between the FTSE Weekly Planets and its long-range chart.

A long-range technical chart for the index shows price obeying the confines of a triangle, jumping from the uptrend line and stalling at the downtrend angle. As price gets forced into the business end, it will have to breakout, or break down. The reason I cannot rule out the former is the state of the long-range Canary, which is recording higher peaks even though price has not done so. There are a couple of horizontal technical levels which have "history" and are worth watching closely.

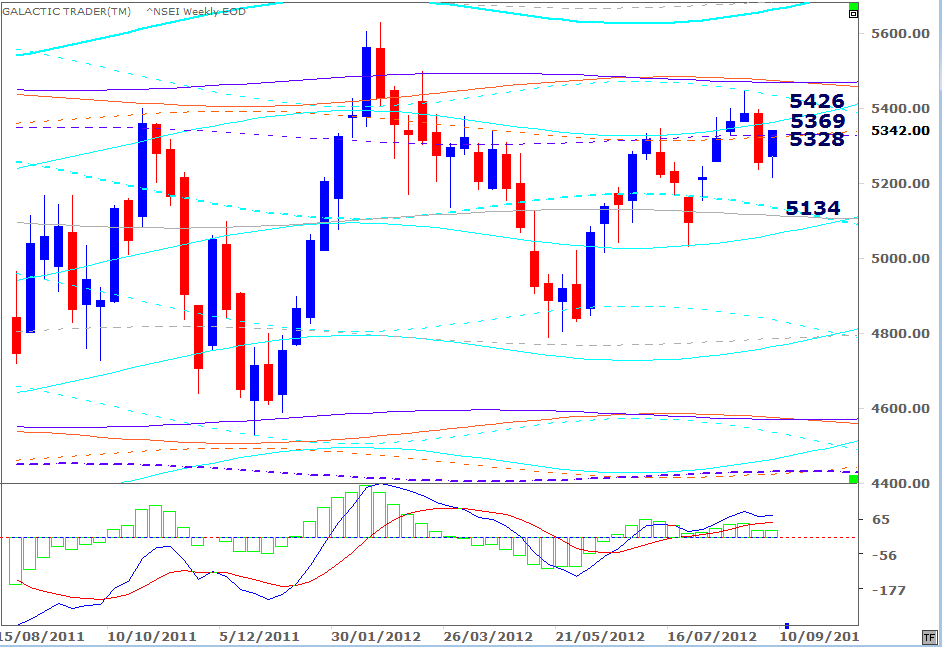

Let's turn now to India's Nifty 50 and update the targets for its Weekly Planets chart.

Let's turn now to India's Nifty 50 and update the targets for its Weekly Planets chart.

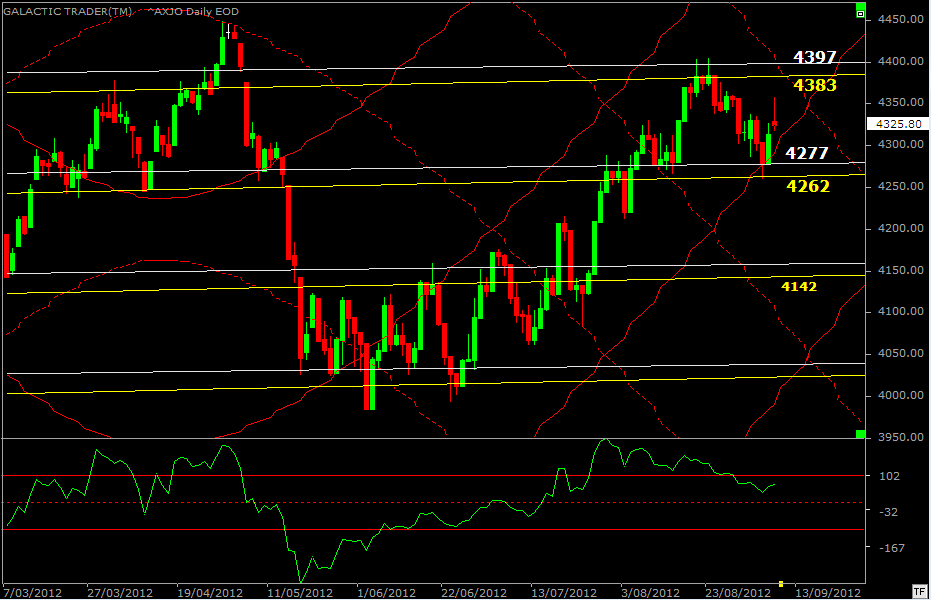

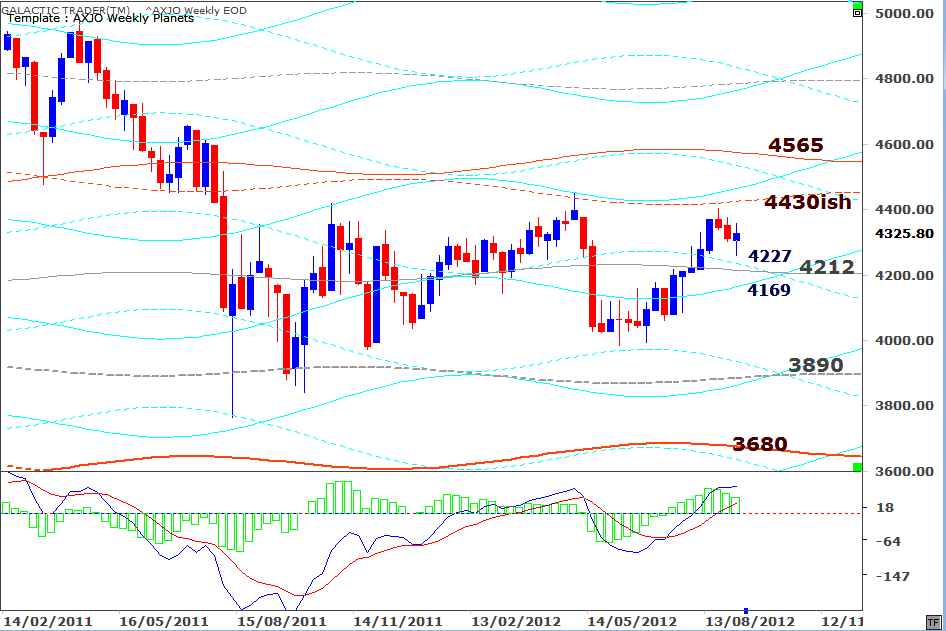

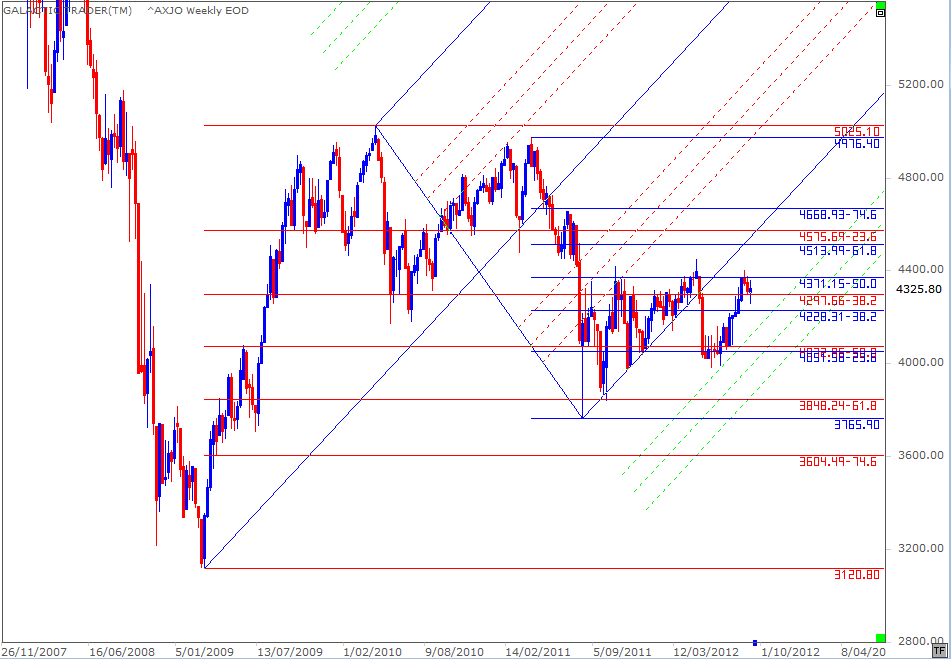

And, finally, we'll take a close look at my home index, the ASX200. Last weekend, I introduced one of my private charts, saying:

"As y'can see, the index has a track record of stopping-and-turning, or at least stalling, when it runs into this particular set of planetary lines. For the week ahead, we can see there'll be a triple effect in play around 4400 on the topside ... and probably not a lot further to drop before Support comes into play."

So, how did it go?

"As y'can see, the index has a track record of stopping-and-turning, or at least stalling, when it runs into this particular set of planetary lines. For the week ahead, we can see there'll be a triple effect in play around 4400 on the topside ... and probably not a lot further to drop before Support comes into play."

So, how did it go?

I cannot, however, rule out the chance the FTSE will pop.

Far from shabby, as it turns out. The "probably not a lot further to drop" price markers were at 4277 and 4262 and Auntie put in a Low of 4161.20 ... less than a dollar off the target, before bouncing strongly.

The chart is helpful for setting Entry and Exit points for moves when the index is trapped within a Weekly Planets range, as shown in the chart below.

The chart is helpful for setting Entry and Exit points for moves when the index is trapped within a Weekly Planets range, as shown in the chart below.

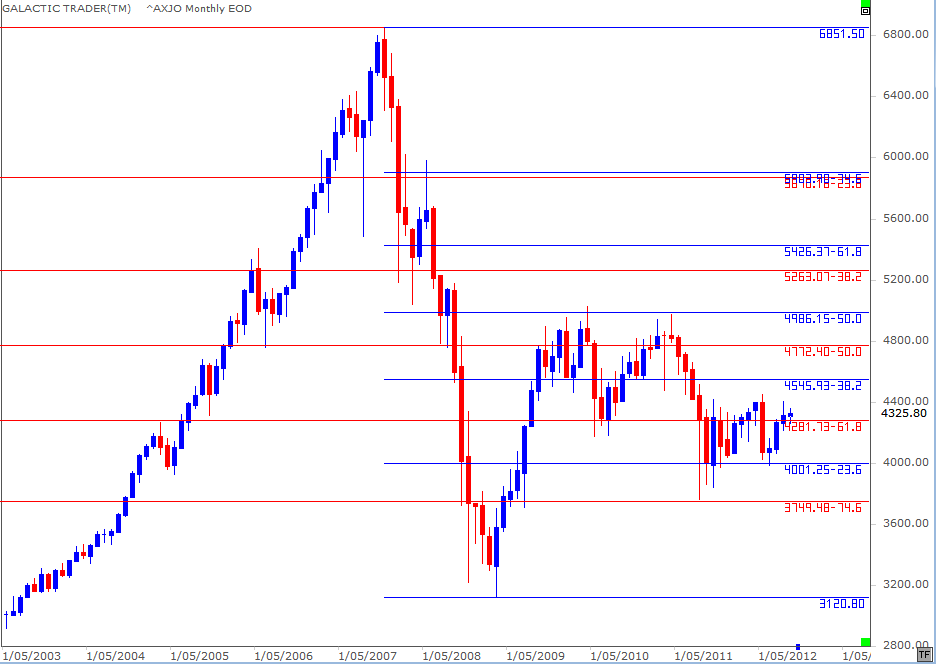

Now, while these Old Gods charts form the basis of one of the main chapters of The Idiot & The Moon, I'd remind you they're not the only show in town and Fibonacci Retracement and Extension levels are a perfectly workable alternative method, particularly for newbies and the budget conscious.

If you need good stock software - dirt cheap - you'll find a link to Incredible Charts under the Software button in the main navigation menu. The free version will do the job very well and can be easily configured to do most of the tasks outlined in The Technical Section.

We'll use the next two charts as working examples.

If you need good stock software - dirt cheap - you'll find a link to Incredible Charts under the Software button in the main navigation menu. The free version will do the job very well and can be easily configured to do most of the tasks outlined in The Technical Section.

We'll use the next two charts as working examples.

Now the methodology is the same, regardless of the timeframe of the chart. We'll look firstly at the long-range and it's clear two sets of Fibo Rx levels are important - the red retracement of the Bull market from 2002-2007 and blue retracement of the 2007-2009 Bear.

We can see the next upside target in the blue range is in the mid 4500s, which coincides pretty closely with one of the intermediate-range targets on Auntie's Weekly Planets chart. Beyond that, 50% of the red range comes into play at 4772. I've mentioned before that this index has been playing to 50% Fibonacci Rx levels on a regular basis.

And that tendency is the core of Auntie's current problem.

We can see the next upside target in the blue range is in the mid 4500s, which coincides pretty closely with one of the intermediate-range targets on Auntie's Weekly Planets chart. Beyond that, 50% of the red range comes into play at 4772. I've mentioned before that this index has been playing to 50% Fibonacci Rx levels on a regular basis.

And that tendency is the core of Auntie's current problem.

In the chart above, the blue levels are the range from the lower double top down into last year's August plunge. There have been three attempts by the index to break that 50% barrier and each one has failed quickly. So far. Nonetheless, we again get targets in the 4500s, if Auntie can finally break north above 4371.

We've been keeping an eye on the upside breakout levels for a few weeks now, even though it seemed madness to push prices back into the irrational exuberance zone with so many economies faltering badly. I've attempted this weekend to show the maximum probable reach. It's a madness which could extend to the American elections, especially if the big boys have made the decision they want Obama back, rather than Romney/Ryan and the Tea Party people.

We've been keeping an eye on the upside breakout levels for a few weeks now, even though it seemed madness to push prices back into the irrational exuberance zone with so many economies faltering badly. I've attempted this weekend to show the maximum probable reach. It's a madness which could extend to the American elections, especially if the big boys have made the decision they want Obama back, rather than Romney/Ryan and the Tea Party people.