Stocks and gold hit an inflection point

Week beginning March 3, 2014

Pollyanna, the SP500, logged a new all-time High on Friday, just a tad above the 1864 planetary line we thought should be hit last week.

Copyright: Randall Ashbourne - 2011-2014

Mercury has now finished its Retrograde cycle, but both Mars and Saturn have now gone Retrograde and Jupiter will change from Retrograde to Direct later this week, just after Venus changes signs to Aquarius.

This morning, I've hit the "publish" button on the Archives 2014 page three times ... and three different versions of the page have appeared online, all containing some sort of gremlin. Merc Rx can really give you the ... irrits!

Trading in the next few days should tell us whether this rally is now ready to roll over, given the apparent divergence between the Pollyanna index and the relative under-performance of other major indices.

If the rally does now fail, the correction is likely to run an intermediate length - several weeks, rather than days.

Alternatively, Miss Polly - and others - will spurt ahead, with the SP500 probably heading above 1900.

This morning, I've hit the "publish" button on the Archives 2014 page three times ... and three different versions of the page have appeared online, all containing some sort of gremlin. Merc Rx can really give you the ... irrits!

Trading in the next few days should tell us whether this rally is now ready to roll over, given the apparent divergence between the Pollyanna index and the relative under-performance of other major indices.

If the rally does now fail, the correction is likely to run an intermediate length - several weeks, rather than days.

Alternatively, Miss Polly - and others - will spurt ahead, with the SP500 probably heading above 1900.

The Nasdaq 100 also managed a new High, but the Dow Jones Industrials did not ... and nor did most of the other major world indices.

This weekend is highlighted in Forecast 2014 as a potential turning point, with the next major turn not due, astrologically, until the second half of April.

This weekend is highlighted in Forecast 2014 as a potential turning point, with the next major turn not due, astrologically, until the second half of April.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

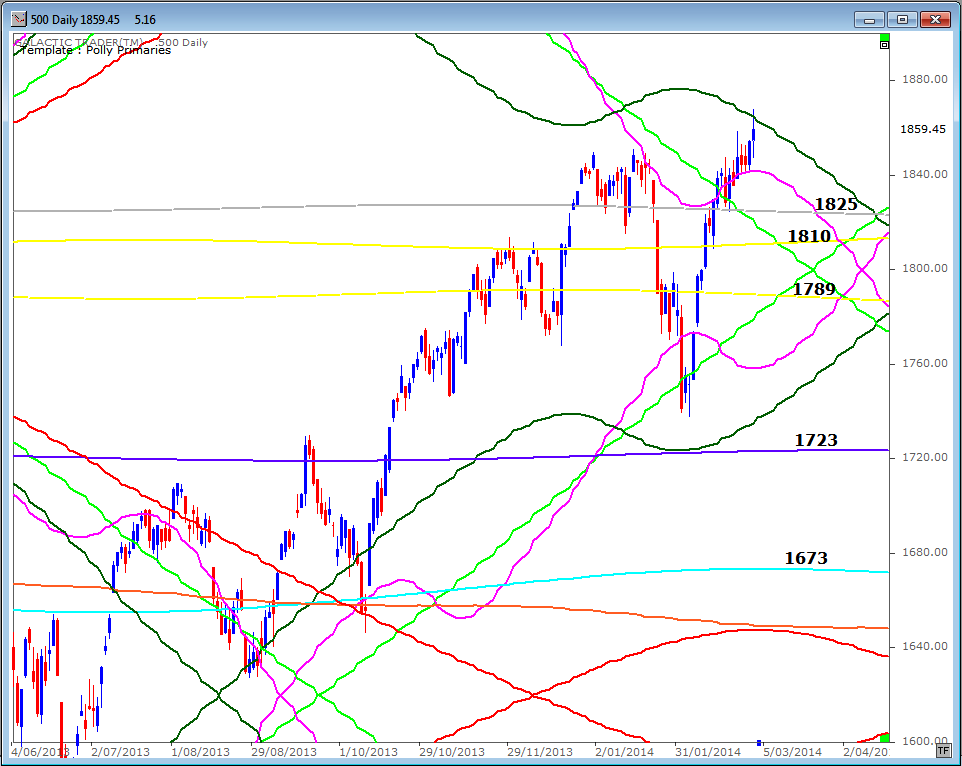

We'll begin this weekend by taking another look at Polly's primary planets chart we've been using for the past few weeks. I indicated the 500 was playing in a price zone defined by two sets of primary planet lines ... one rising and the other falling.

The index continued to maintain contact with the pink Mercury line for the first four days of last week, surging on Friday to make a potential false break of the falling, dark-green Venus line.

The index continued to maintain contact with the pink Mercury line for the first four days of last week, surging on Friday to make a potential false break of the falling, dark-green Venus line.

If the rally now stalls and prices decline, we have some idea of the downside targets. If it continues heading north, we can use the Weekly Planets chart to determine the upside targets.

I said last weekend: "Since we're in the statistically-positive period between 3Q and New Moon ... and with the Sun due to trine Jupiter ... 1864 remains a valid target for the coming week."

Polly went to 1867.92 on Friday, before backing away. There is another layer of Saturn price resistance just below the 1880s. However, a breakout above 1864, is likely to open up the 1920s area as the next major target for the rally.

I said last weekend: "Since we're in the statistically-positive period between 3Q and New Moon ... and with the Sun due to trine Jupiter ... 1864 remains a valid target for the coming week."

Polly went to 1867.92 on Friday, before backing away. There is another layer of Saturn price resistance just below the 1880s. However, a breakout above 1864, is likely to open up the 1920s area as the next major target for the rally.

NEW:

Forecast 2014 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

We also need to watch what happens now with the Bollinger Band scrunching on the weekly charts. I mentioned this last weekend, since the Bi-BB trading rules outlined in The Technical Section of The Idiot & The Moon worked so well on daily charts in the preceding weeks of decline and bounceback.

If the rally reverses course, we need to bear in mind that the first move is likely to be in the wrong direction - meaning that after the potential correction completes, the index will launch into a very strong rally spike. And, if the bands suddenly start to widen as Polly soars north into the 1900s, we need to be aware that it will be the final leg of the current rally and will be followed by a very sharp and fast plunge.

If the rally reverses course, we need to bear in mind that the first move is likely to be in the wrong direction - meaning that after the potential correction completes, the index will launch into a very strong rally spike. And, if the bands suddenly start to widen as Polly soars north into the 1900s, we need to be aware that it will be the final leg of the current rally and will be followed by a very sharp and fast plunge.

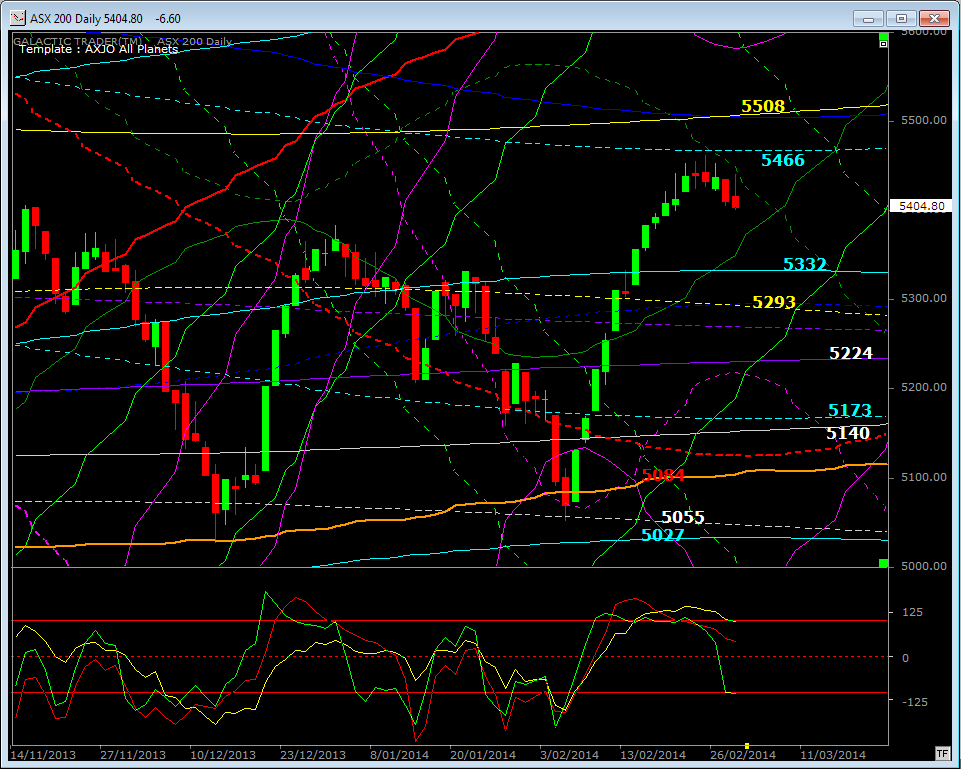

Last weekend, we also took a look at the planetary lines containing price action on the ASX200 and I indicated the relative strength of the Big Bird oscillator suggested 5466 or 5504 should be hit last week ... but that the other Birds were rolling over "suggesting the end of this rally is now very close".

Auntie didn't quite hit 5466, but is now fairly obviously falling under the influence of a downtrending Venus line.

Auntie didn't quite hit 5466, but is now fairly obviously falling under the influence of a downtrending Venus line.

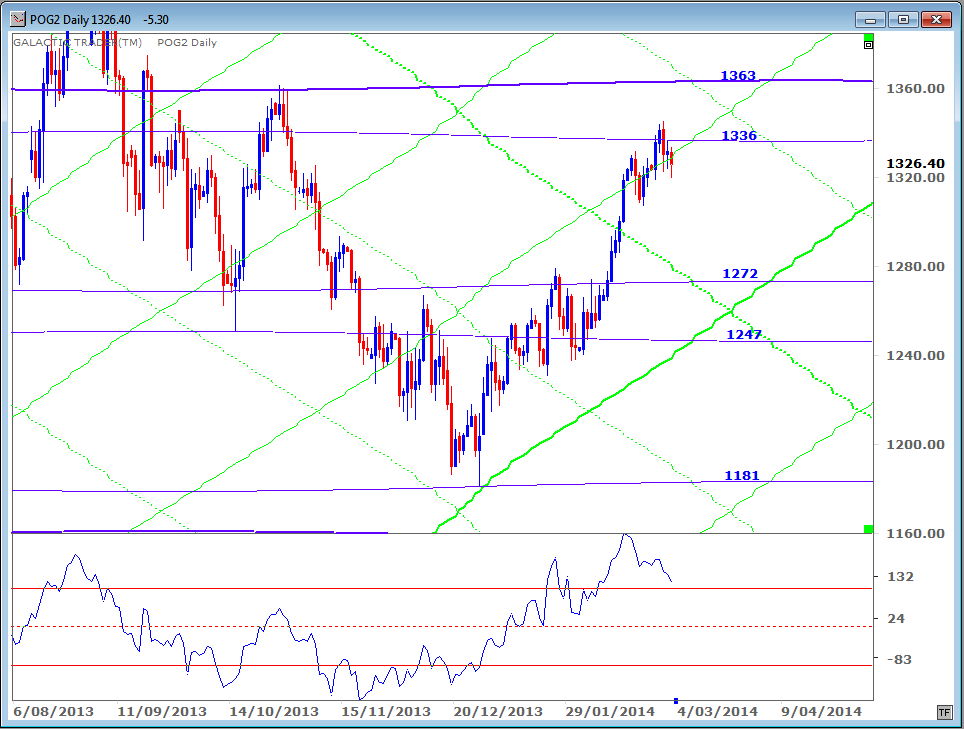

The price of gold has stalled after a one-day break of the 1336 Pluto line and is also in danger of losing the support of a rising Sun line. Intermediate-range positive divergence remains intact on weekly charts, but Big Bird is not a picture of glowing health on the daily, where the last price high coincided with a decidely lower peak in the oscillator.

It would seem then that both stocks and gold have arrived at an inflection point, having reached the planetary price targets we thought "should" be hit ... with a smidgeon over on Polly and a whisker under on the ASX.

The next move isn't obvious ... well, it's not to me. I lean more towards a probable decline, but there is a danger in getting married to that expectation. Hopefully, the next few days will provide greater certainty.

The next move isn't obvious ... well, it's not to me. I lean more towards a probable decline, but there is a danger in getting married to that expectation. Hopefully, the next few days will provide greater certainty.