April ... the month that could be "it"!

Week beginning March 31, 2014

Monday brings the end-of-month and end-of-quarter, a time when the bonus babies cook the books to ensure a nice, fat cheque is in the mail.

Copyright: Randall Ashbourne - 2011-2014

Of course, I am talking about astrological expectations ... and those of you who have read last weekend's special report on gold know that I reiterated my view about relying on expectations of any kind.

Still, I showed in Forecast 2014 the huge pile-up of planetary energy due to be unleashed in the latter part of the month when Mars, Jupiter, Uranus and Pluto will be lined-up in a configuration called a Cardinal Grand Square. And, as we've discussed before, the Cardinal signs and transiting Squares are very much "action" signatures.

It will be compounded by the first Solar and Lunar eclipses of the year. We should get a small taste of the energy in the coming week, when the travelling Sun, now in the action sign of Aries, squares Jupiter, conjuncts Uranus and squares Pluto.

Still, I showed in Forecast 2014 the huge pile-up of planetary energy due to be unleashed in the latter part of the month when Mars, Jupiter, Uranus and Pluto will be lined-up in a configuration called a Cardinal Grand Square. And, as we've discussed before, the Cardinal signs and transiting Squares are very much "action" signatures.

It will be compounded by the first Solar and Lunar eclipses of the year. We should get a small taste of the energy in the coming week, when the travelling Sun, now in the action sign of Aries, squares Jupiter, conjuncts Uranus and squares Pluto.

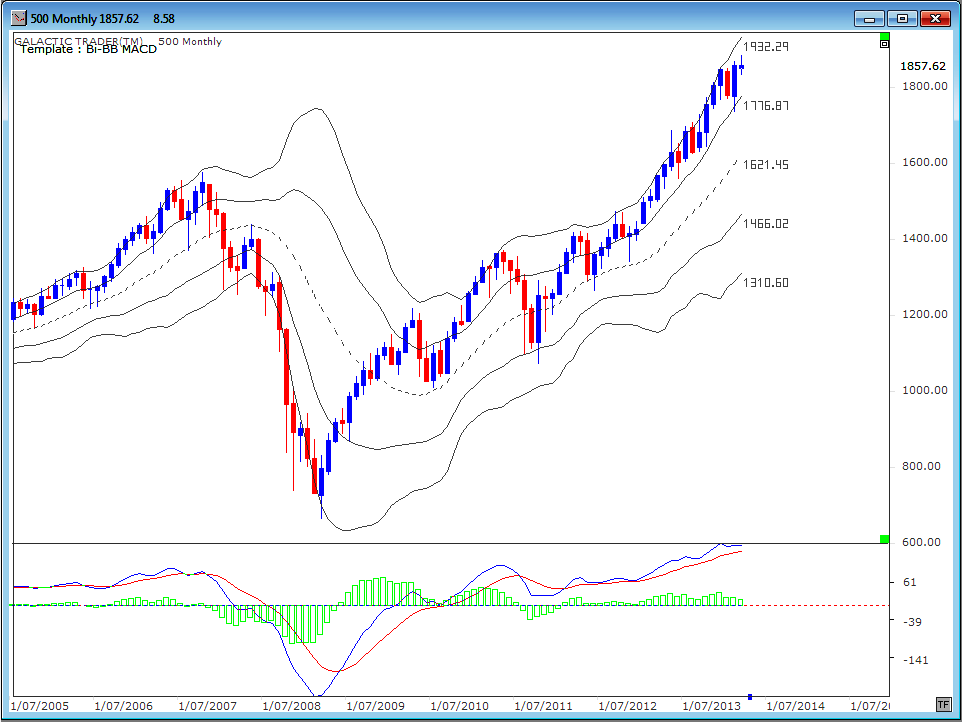

And unless Monday brings an explosive splurge, Wall Street's main index, the SP500, will finish March leaving a price bar that could be The Top.

April shows all the signs of a long-range turn in the tide.

April shows all the signs of a long-range turn in the tide.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

In the chart below, Sun conjunct Uranus is marked with blue bars; Sun square Pluto with red bars; and Sun square Jupiter with green bars.

I've circled the three previous instances where the Sun's conjunction with Uranus happened almost simultaneously with a square to Pluto. And I'm not sure from the track record that we can draw any reliable conclusion.

In fact, the Sun squares to Jupiter (the green bars) seem to have more impact; there seems to be a tendency to accelerate the existing trend - whether it's up or down. This week will be the first time the Sun makes aspects to all three outer planets within a few days ... so, I would expect the month-long sideways shuffle is about to end abruptly.

I've circled the three previous instances where the Sun's conjunction with Uranus happened almost simultaneously with a square to Pluto. And I'm not sure from the track record that we can draw any reliable conclusion.

In fact, the Sun squares to Jupiter (the green bars) seem to have more impact; there seems to be a tendency to accelerate the existing trend - whether it's up or down. This week will be the first time the Sun makes aspects to all three outer planets within a few days ... so, I would expect the month-long sideways shuffle is about to end abruptly.

The shuffle is probably best seen using the 500's daily bars on the index's Weekly Planets chart, where nearly all of the price action since late February has been constrained upside and downside by Saturn price barriers. This is either accumulation for a splurge higher ... or the big boys have been quietly selling over the past 6 weeks.

NEW:

Forecast 2014 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

There is not, in my mind, such clear-cut evidence from the state of the daily oscillator to be able to predict the next move with any real certainty.

However, the level of negative divergence continues to build very solidly on both weekly and monthly charts, regardless of whether we're consulting the Canaries or the fast MACD.

And we are likely to have Pollyanna end the month leaving a bar that's potentially quite dangerous. What we have, in essence, is a bar that highlights a rather extreme amount of indecision.

It displays a very tight range, where both the upside and the downside have been tested ... and the bar seems likely to finish Monday trading in the middle of that range. In short, no-one seems certain what to do next.

However, the level of negative divergence continues to build very solidly on both weekly and monthly charts, regardless of whether we're consulting the Canaries or the fast MACD.

And we are likely to have Pollyanna end the month leaving a bar that's potentially quite dangerous. What we have, in essence, is a bar that highlights a rather extreme amount of indecision.

It displays a very tight range, where both the upside and the downside have been tested ... and the bar seems likely to finish Monday trading in the middle of that range. In short, no-one seems certain what to do next.

My "expectation" is that April will bring an end to the indecision. We break out, or we break down. The Wall Street indices aren't alone in this condition.

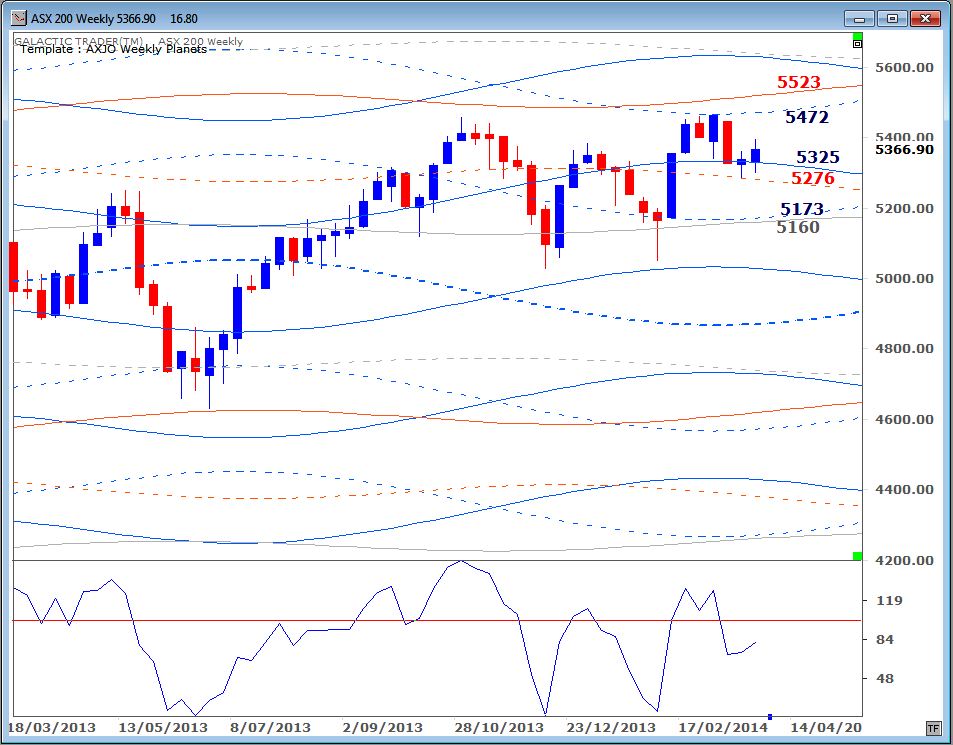

The ASX 200 has also spent the past 6 weeks largely contained by its Weekly Planets Saturn barriers. Again, the Big Bird weekly oscillator is not giving any obvious and clear hints as to whether it will be a break to the upside or downside ... but at least we have the key price levels to watch for the first clues.

The ASX 200 has also spent the past 6 weeks largely contained by its Weekly Planets Saturn barriers. Again, the Big Bird weekly oscillator is not giving any obvious and clear hints as to whether it will be a break to the upside or downside ... but at least we have the key price levels to watch for the first clues.

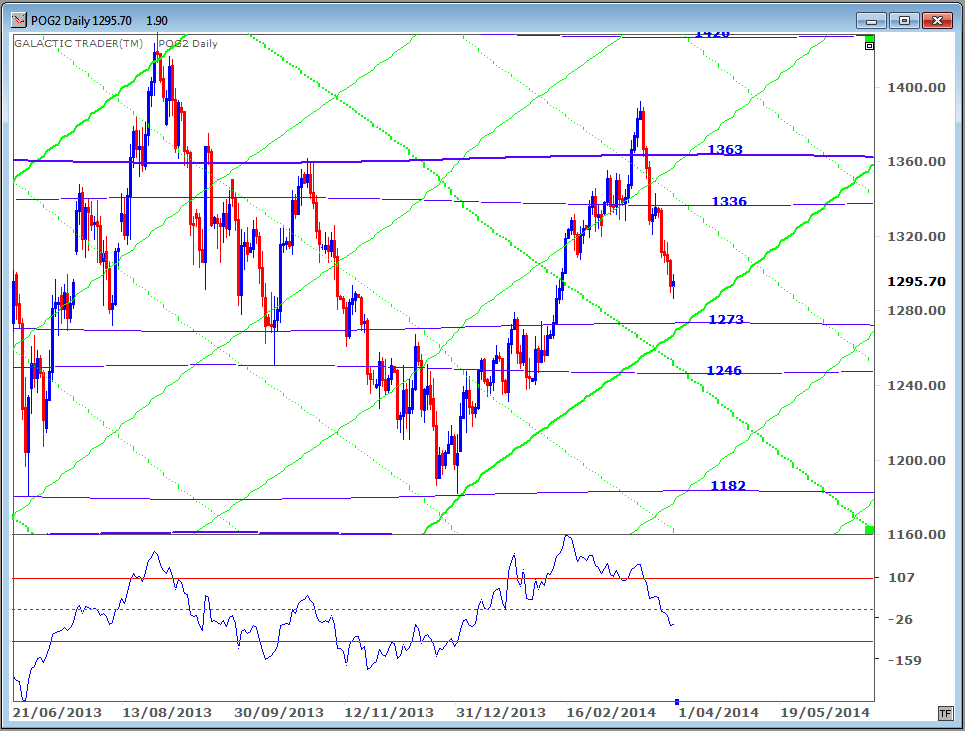

Now let's turn our attention to gold. I went through the big picture in last weekend's special report and you know I've been expecting some sort of retest of the rising primary Sun line.

That retest got underway during the past week. There is an intersection of the rising primary Sun with a secondary Pluto horizontal in the next few days - at $1273. It is an "obvious" bounce level if it is hit.

That retest got underway during the past week. There is an intersection of the rising primary Sun with a secondary Pluto horizontal in the next few days - at $1273. It is an "obvious" bounce level if it is hit.

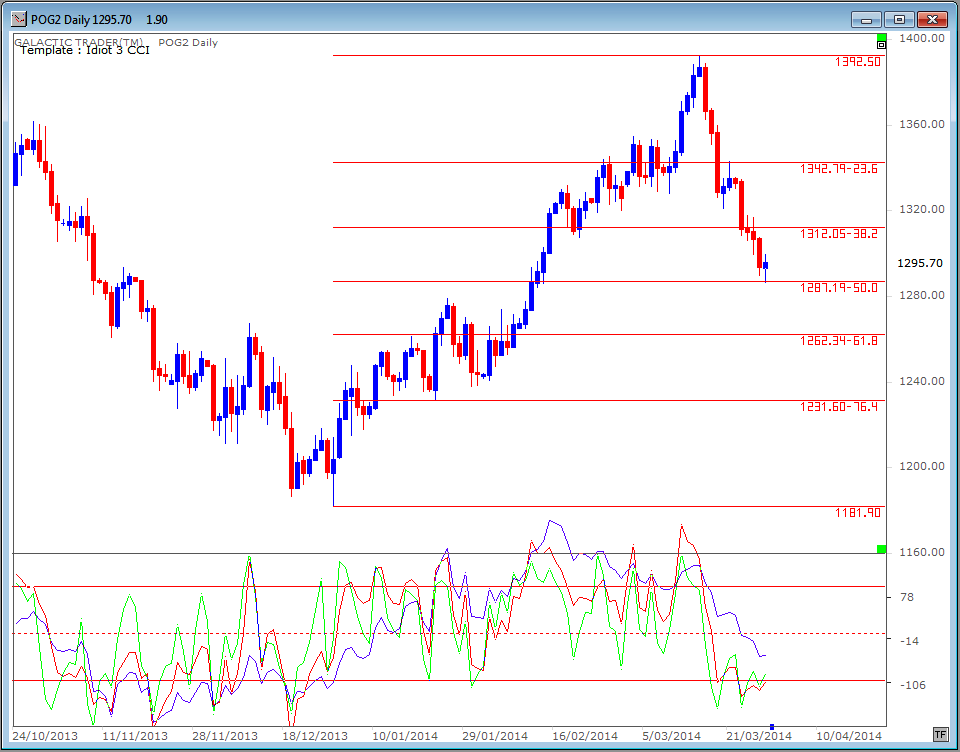

There is no guarantee it will be hit, however, since Friday bounced from another "obvious" level - the 50% retracement marker of the post-December rally. This could be an important level, and if it can hold, leaves gold in a position to mount another strong rally leg.

We are getting signals from the 3 Birds of a potential turnaround in the gold price. The green Fast Bird is turning and is above the red Medium Bird, which is also starting to diverge from the price plunge. If you're watching the charts of the gold miners, some of those are already showing a shift in the stacking of the Birds into approaching rally mode ... meaning both Fast and Medium Birds have already climbed higher than the blue Big Bird.