Heading into a major Bradley date

Week beginning July 7, 2014

The USA is having a Happy Birthday weekend ... with Wall Street the happiest of all.

Copyright: Randall Ashbourne - 2011-2014

In the next few days, the Sun will square Uranus and trine Saturn. The Moon will spend a couple of days in Sagittarius, which can spark wide-range days full of either fear or unbridled optimism, before heading into the Full Moon next weekend.

That Full Moon will be conjunct Pluto and square to Uranus, in a repetition of the main astrological theme being played out in the skies.

But, it'll also be a major part of what happens in north America over the next year. Astrologers often construct what's called a Solar Return chart on someone's birthday. The themes suggested in that chart tend to last for the next year.

That Full Moon will be conjunct Pluto and square to Uranus, in a repetition of the main astrological theme being played out in the skies.

But, it'll also be a major part of what happens in north America over the next year. Astrologers often construct what's called a Solar Return chart on someone's birthday. The themes suggested in that chart tend to last for the next year.

But the celebration fireworks might spill over into the stock market in the next week or two.

We're now heading into one of the three major Bradley Model turn dates scheduled for this year.

We're now heading into one of the three major Bradley Model turn dates scheduled for this year.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

It means the USA will spend the next year trying to deal with the social, economic and geopolitical unrest indicated by the long-range Uranus/Pluto square.

That's because, on its birthday, the USA's Sun was locked into the configuration. And so was the Moon, which was transiting through Libra. In brief, the public "mood" over the next year will want to see some fairness and balance. And that will be at odds with the other three players.

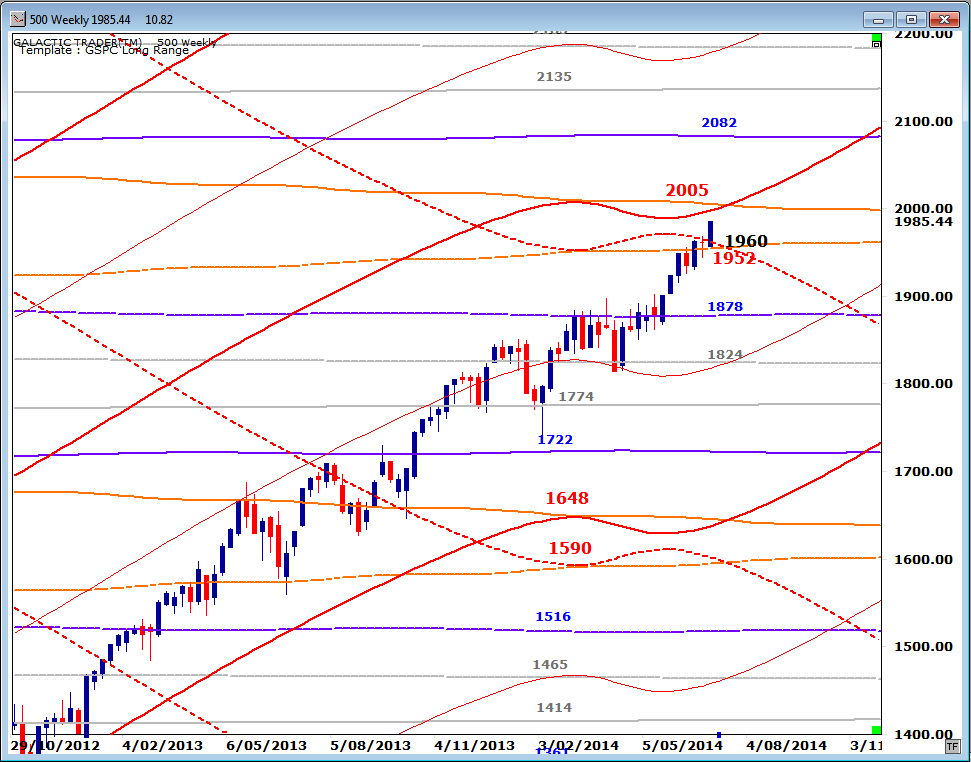

Meanwhile, the SP500 and a few other indices soared to new highs last week. Pollyanna's price has jumped above the first of the two Mars price lines within an important Node zone priced from around 1950 to just above 2000.

That's because, on its birthday, the USA's Sun was locked into the configuration. And so was the Moon, which was transiting through Libra. In brief, the public "mood" over the next year will want to see some fairness and balance. And that will be at odds with the other three players.

Meanwhile, the SP500 and a few other indices soared to new highs last week. Pollyanna's price has jumped above the first of the two Mars price lines within an important Node zone priced from around 1950 to just above 2000.

And it is rising into those levels as the Bradley Model heads into one of the potentially most important dates of the year. I've cautioned before that it is the dates of the Bradley which are most important ... not the direction of the oscillator, marked with a black line on the chart below.

December 31 marked a high, for example, rather than a low. It was a high which remained untested for two months as the index plunged into a February 5 low. February 3 was a minor blip on the Bradley oscillator.

December 31 marked a high, for example, rather than a low. It was a high which remained untested for two months as the index plunged into a February 5 low. February 3 was a minor blip on the Bradley oscillator.

As I mentioned last weekend, the mid-July Bradley date coincides with Jupiter's sign shift into Leo, which will accelerate a change in the popularity of stock sectors.

In the years when it works, the Bradley Model can be uncannily accurate ... in terms of the dates, not necessarily the implied direction.

And since it was only one day off marking December 30 as a trend change date, which led to a sharp decline, we should all probably keep a close eye on another big shift happening very soon.

The Australian market also responded positively last week, bouncing back for another touch of an upside Weekly Planets barrier.

In the years when it works, the Bradley Model can be uncannily accurate ... in terms of the dates, not necessarily the implied direction.

And since it was only one day off marking December 30 as a trend change date, which led to a sharp decline, we should all probably keep a close eye on another big shift happening very soon.

The Australian market also responded positively last week, bouncing back for another touch of an upside Weekly Planets barrier.

The next resistance level is around 5570 ... with Neptune at 5625 above that, if the ASX200 can manage a breakout.