More fast moves as Mars goes Cardinal

Week beginning July 2, 2012

Obviously, the bounce was not done. Mea Culpa. I rather seriously under-estimated the end-of-half-year effect and, with the benefit of hindsight, ought to have been even more wary of Goldman's recent call to Short the market.

Copyright: Randall Ashbourne - 2011-2012

Even as late as Thursday, Wall Street seemed to be heading down further - until one of the high frequency traders lodged a $3.3 billion Buy order on the S&P e-mini. There's probably no need to speculate where the cash came from - it'd be part of the bailout billions being transferred from pension cuts and other "austerity" measures to the bankers' bonus fund.

Strange, is it not, how "rogue" traders within the banks just keep popping up? The Barclays boys manipulating interest rates and not caring how your mortgage is affected; the JP Morgan boys who lose a billion or two ... or more; Goldmans publicly releasing a Short recommendation, just before markets launch into an end-of-June spike higher?

Stranger still that their bosses claim complete ignorance. One might have thought that even if they weren't complicit, their absolute incompetence at handling their staff is deserving of at least a mild slap on the wrist.

Strange, is it not, how "rogue" traders within the banks just keep popping up? The Barclays boys manipulating interest rates and not caring how your mortgage is affected; the JP Morgan boys who lose a billion or two ... or more; Goldmans publicly releasing a Short recommendation, just before markets launch into an end-of-June spike higher?

Stranger still that their bosses claim complete ignorance. One might have thought that even if they weren't complicit, their absolute incompetence at handling their staff is deserving of at least a mild slap on the wrist.

I did indicate last weekend the Masters of the Universe could have another bounce planned to unload more over-priced stock; I'd thought it would occur from a lower price level.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Still, the question we must now face is whether this was nothing more than end-of-June window-dressing and now that the books have been cooked enough to lock-in the next bonus payment, whether the Masters will lose interest until we get closer to the 3Q period.

Astrologically, too, the extreme high-energy levels of the past week or so will begin to wind down. The general themes, however, will continue to develop because the Uranus-Pluto square is an aspect that stays in effect all the way to 2015.

There is only one significant astro event in the coming week, apart from the Full Moon, and that is a Mars sign shift into Libra, one of the four Cardinal, or action, signs.

I thought we might begin this weekend by taking a look at the impact of Mars moving into the Cardinal signs.

Astrologically, too, the extreme high-energy levels of the past week or so will begin to wind down. The general themes, however, will continue to develop because the Uranus-Pluto square is an aspect that stays in effect all the way to 2015.

There is only one significant astro event in the coming week, apart from the Full Moon, and that is a Mars sign shift into Libra, one of the four Cardinal, or action, signs.

I thought we might begin this weekend by taking a look at the impact of Mars moving into the Cardinal signs.

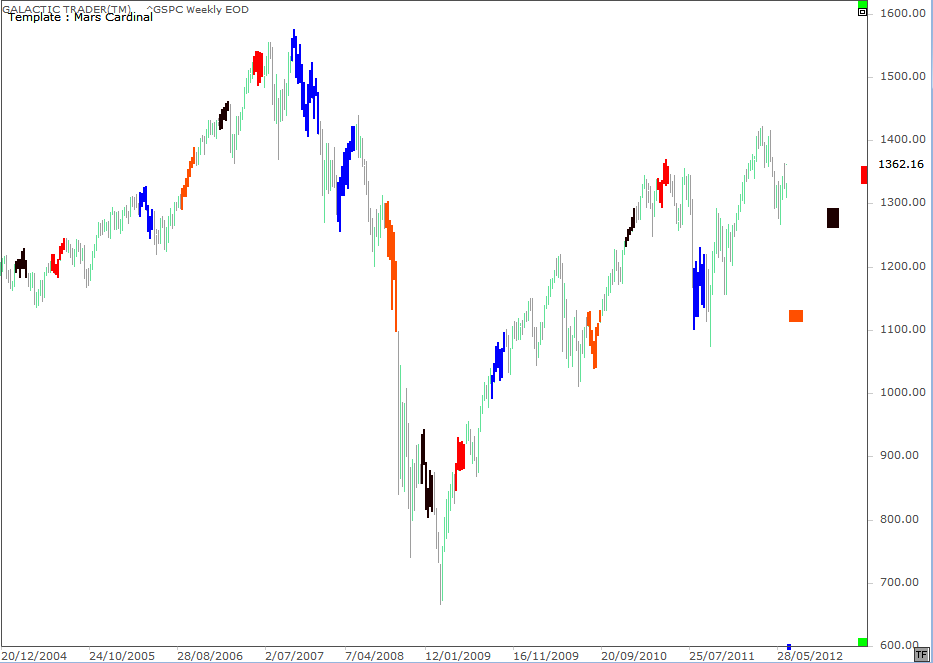

Our first chart for this week is a relatively long-range look. The red bars are Mars in Aries; blue is Mars in Cancer; orange is Mars in Libra; and black is Mars in Capricorn.

What is immediately noticeable is just how often Mars is in one of the Cardinal signs near important Highs and Lows. Also fairly consistent is the acceleration of the trend in other instances. So, there is some "eyeball" evidence that Mars entering a Cardinal sign has a tendency to either change, or accelerate, a trend.

What is immediately noticeable is just how often Mars is in one of the Cardinal signs near important Highs and Lows. Also fairly consistent is the acceleration of the trend in other instances. So, there is some "eyeball" evidence that Mars entering a Cardinal sign has a tendency to either change, or accelerate, a trend.

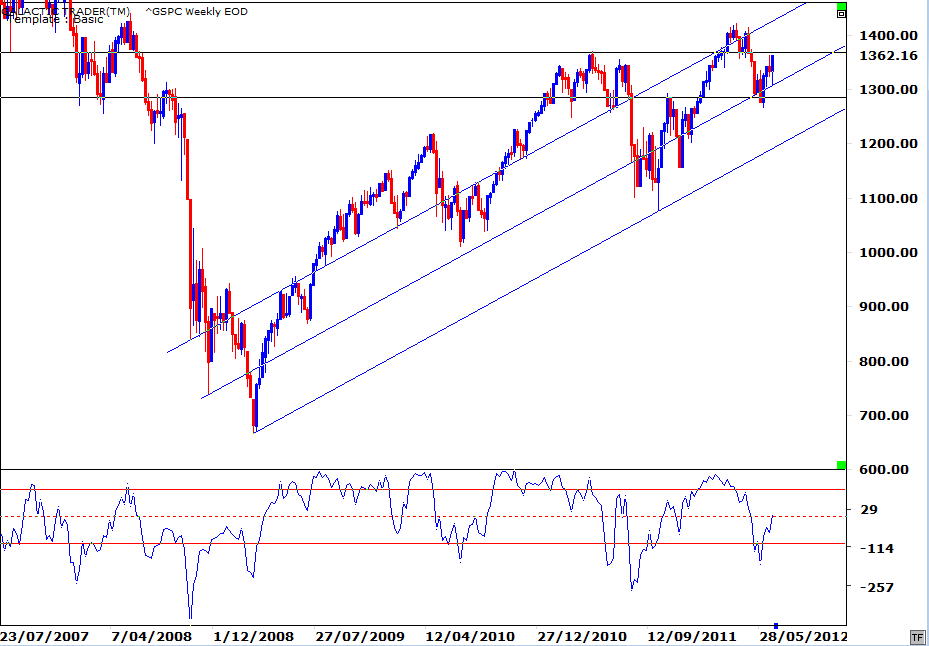

There are currently only two lines of real importance for the SP500 - and they've been in play for a long time. There is no quibbling with the chart above. Miss Pollyanna is in an uptrend. Full stop. My prediction is that it has already entered the first stage of a new Bear leg down.

But, astrological expectations do not over-ride technical conditions - and the prediction may yet turn out to be just plain wrong.

We probably don't have to wait long to find out, with Mars moving into Libra. But we do need to see what the potential targets are in both directions.

But, astrological expectations do not over-ride technical conditions - and the prediction may yet turn out to be just plain wrong.

We probably don't have to wait long to find out, with Mars moving into Libra. But we do need to see what the potential targets are in both directions.

Friday's spike brought the index back towards its recent high. It's difficult to get a solid lead from the fast MACD, though a new price high in these circumstances would be the norm, rather than an exception. The MACD signal line has gone positive without having dropped below zero, which is usually a sign of a continuing rally. The histograms, however, are more than a tad ambivalent about the sharp recovery from Thursday's low.

So, in the short term, we have a couple of price markers that are important. The index needs to break above the 618 retracement and then go on to challenge the 764.

So, in the short term, we have a couple of price markers that are important. The index needs to break above the 618 retracement and then go on to challenge the 764.

And we can consult the weekly Bi-BB chart for the intermediate targets if those relatively minor levels do get broken. Friday's spike brought the index back to the middle BB, after spending most of the past 3 weeks within the higher portion of the lower tier.

So, if Mars in Libra prompts an acceleration, we will probably see the SP500 break to new recovery highs within the next few weeks. If it turns the trend down again, there's also likely to be an acceleration and the lower levels are very unlikely to hold.

So, if Mars in Libra prompts an acceleration, we will probably see the SP500 break to new recovery highs within the next few weeks. If it turns the trend down again, there's also likely to be an acceleration and the lower levels are very unlikely to hold.

We're most interested in what Mars tends to do when it enters Libra, which is what comes into play early this week. You may find it a tad difficult to differentiate the orange from the red. The orange bars follow the blue bars. We can see three examples of it on the chart above.

The first instance accelerated the trend heading upwards in late 2006; the second accelerated the downtrend in 2008; and the third produced a rebound and acceleration in the second half of 2010.

So the odds tend to favour a fast move for stock markets in the coming weeks. Lines of either Support or Resistance will be broken with relative ease while the action planet travels one of the action signs.

The first instance accelerated the trend heading upwards in late 2006; the second accelerated the downtrend in 2008; and the third produced a rebound and acceleration in the second half of 2010.

So the odds tend to favour a fast move for stock markets in the coming weeks. Lines of either Support or Resistance will be broken with relative ease while the action planet travels one of the action signs.

Either way, Pollyanna's long-range planets chart shows us the key targets for any sustained rally or decline.

London's FTSE last week caught yet another bounce from the rising Sun diagonal I've discussed in the past few weekend editions. It has yet to overcome the barrier of the primary Saturn line, just overhead at 5628. I've marked the prices of the higher targets if it manages to breakout.

In terms of the bigger picture, it's worth looking at a Gann chart of the FTSE. The early stages of the recovery run following the 2009 Bear bottom kept contact with the fast Gann angles. The rally stalled out in 2010, moving price off the fast angles and bringing about a decline to the primary Gann angle.

In May, the index recorded its first close below that angle - increasing the probability of a new Bear leg down. Thanks to Friday's spike, June has closed out with the FTSE regaining the primary Gann uptrend angle, which casts doubt on the Bear prediction.

Believe me ... I'm not happy sitting on the fence. But the Masters have managed in the past couple of days to bounce these indices back into a zone where breakout or breakdown are both possible - especially with the imminent arrival of a hyperactive Marshun.

I'll leave you this weekend with Auntie's Weekly Planets chart for the ASX200 ... and a Happy Birthday wish for the American cousins.

In May, the index recorded its first close below that angle - increasing the probability of a new Bear leg down. Thanks to Friday's spike, June has closed out with the FTSE regaining the primary Gann uptrend angle, which casts doubt on the Bear prediction.

Believe me ... I'm not happy sitting on the fence. But the Masters have managed in the past couple of days to bounce these indices back into a zone where breakout or breakdown are both possible - especially with the imminent arrival of a hyperactive Marshun.

I'll leave you this weekend with Auntie's Weekly Planets chart for the ASX200 ... and a Happy Birthday wish for the American cousins.