Targets for The Top of the Bull market

Week beginning July 15, 2013

We will spend some time this weekend reviewing the growing danger signals that the Bull run is topping out.

Copyright: Randall Ashbourne - 2011-2013

I did also say: "There is some chance the correction is over and the bounce will continue. July tends to be a stronger month for the Wall Street indices than June."

However, repeating that now is just mealy-mouthed arse-covering. Basically, I got it wrong. I'd thought the normal tendency of the Merc Rx cycle, combined with the statistical negativity of the New Moon to Full Moon period would drag on stock markets and it didn't.

There is some danger everyone will do a complete "re-think" when Mercury goes Direct again at the end of this week, especially since the Grand Trine involving Jupiter, Saturn and Neptune becomes exact mid-week. I dealt with this recently and the full report can be found in the Archives.

Once that aspect finishes, the next major one will be Jupiter making a T-square with Uranus and Pluto, an aspect renowned financial astrologer Ray Merriman describes as a "classical" bankruptcy signature.

However, repeating that now is just mealy-mouthed arse-covering. Basically, I got it wrong. I'd thought the normal tendency of the Merc Rx cycle, combined with the statistical negativity of the New Moon to Full Moon period would drag on stock markets and it didn't.

There is some danger everyone will do a complete "re-think" when Mercury goes Direct again at the end of this week, especially since the Grand Trine involving Jupiter, Saturn and Neptune becomes exact mid-week. I dealt with this recently and the full report can be found in the Archives.

Once that aspect finishes, the next major one will be Jupiter making a T-square with Uranus and Pluto, an aspect renowned financial astrologer Ray Merriman describes as a "classical" bankruptcy signature.

I indicated last weekend: "There is a strong chance, at least from an astrological viewpoint, that the next downleg of the multi-week correction is due to start."

However, the normal Mercury Retrograde spurt-and-reverse cycle has not played out.

However, the normal Mercury Retrograde spurt-and-reverse cycle has not played out.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

But, I am much less concerned with The Spooky Stuff than I am with the warning sirens starting to go off in the technical condition of the markets - especially on Wall Street where everyone is hooked on the cheap money the US Federal Reserve has been pumping into the financial system.

Every few years the May to October timeframe produces market behaviour which turns out to be a major, long-range turning point. And this may well be one of those times.

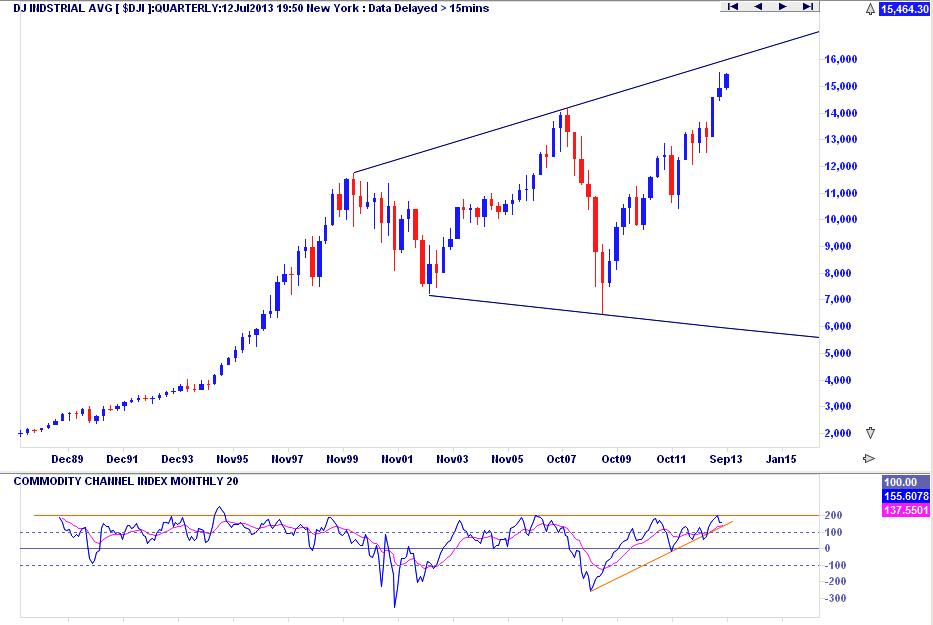

So, let's begin. And, courtesy of the Incredible Charts software, we'll start with a quarterly chart of the Dow Jones Industrials. At an eyeball glance, the DJI appears to be making a multi-decade megaphone pattern. And it has the uberBears drooling. They believe the Dow is getting set to drop not just to the lower line of the "jaws of death", but will plunge down through it.

Maybe, maybe not. That's something we'll have to try to judge sometime in the future; not now. What is concerning is that these new price highs in the DJI are not being fully-endorsed by the mid-range oscillator. I've placed an orange horizontal at its recent peak - and it's a level that has shown up as marking out a topping pattern several times.

For the moment, the oscillator is maintaining its own uptrend angle from the Bear bottom in 2009. But it is starting to falter.

Every few years the May to October timeframe produces market behaviour which turns out to be a major, long-range turning point. And this may well be one of those times.

So, let's begin. And, courtesy of the Incredible Charts software, we'll start with a quarterly chart of the Dow Jones Industrials. At an eyeball glance, the DJI appears to be making a multi-decade megaphone pattern. And it has the uberBears drooling. They believe the Dow is getting set to drop not just to the lower line of the "jaws of death", but will plunge down through it.

Maybe, maybe not. That's something we'll have to try to judge sometime in the future; not now. What is concerning is that these new price highs in the DJI are not being fully-endorsed by the mid-range oscillator. I've placed an orange horizontal at its recent peak - and it's a level that has shown up as marking out a topping pattern several times.

For the moment, the oscillator is maintaining its own uptrend angle from the Bear bottom in 2009. But it is starting to falter.

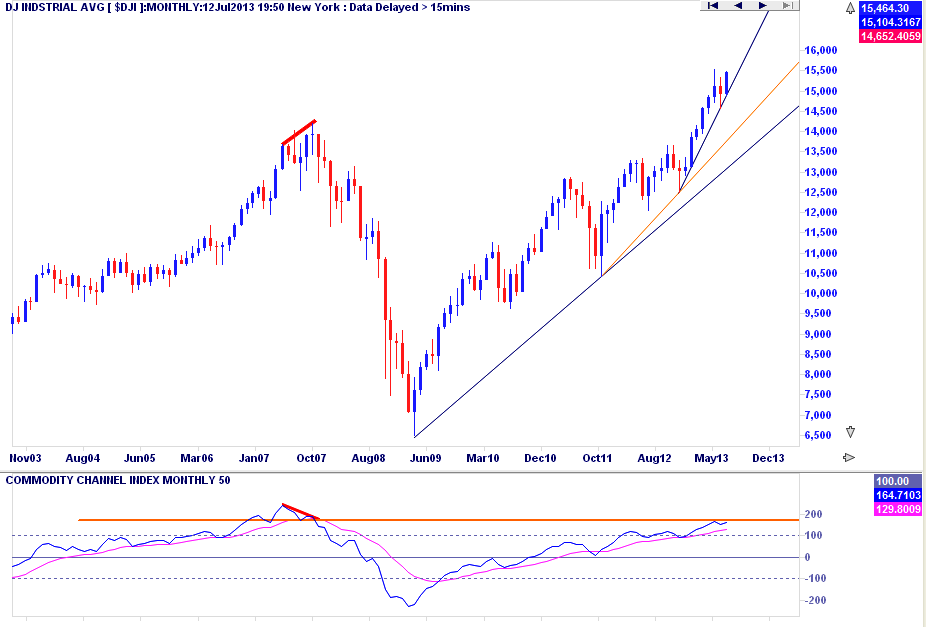

We'll go next to a DJI monthly chart and use the 50CCI ... what I call the long-range Canary, or the Big Bird. We've been watching and waiting for a while now for Big Bird to start to diverge from the price action. If you look at the 2007 topping pattern, I've put a thick, red diagonal on the May-October price action of that year ... and while it went north, Big Bird went south during that period.

For the moment, the DJI's price continues at an angle which is too far, too fast to be sustained ... and while the price of the index has climbed above the 2007 peak, Big Bird has not reached the lofty levels it did then; which is long-range negative divergence in itself.

For the moment, the DJI's price continues at an angle which is too far, too fast to be sustained ... and while the price of the index has climbed above the 2007 peak, Big Bird has not reached the lofty levels it did then; which is long-range negative divergence in itself.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

Forecast 2013 is now available for sale and download.

And since half the year is gone ... it's now half price!

And since half the year is gone ... it's now half price!

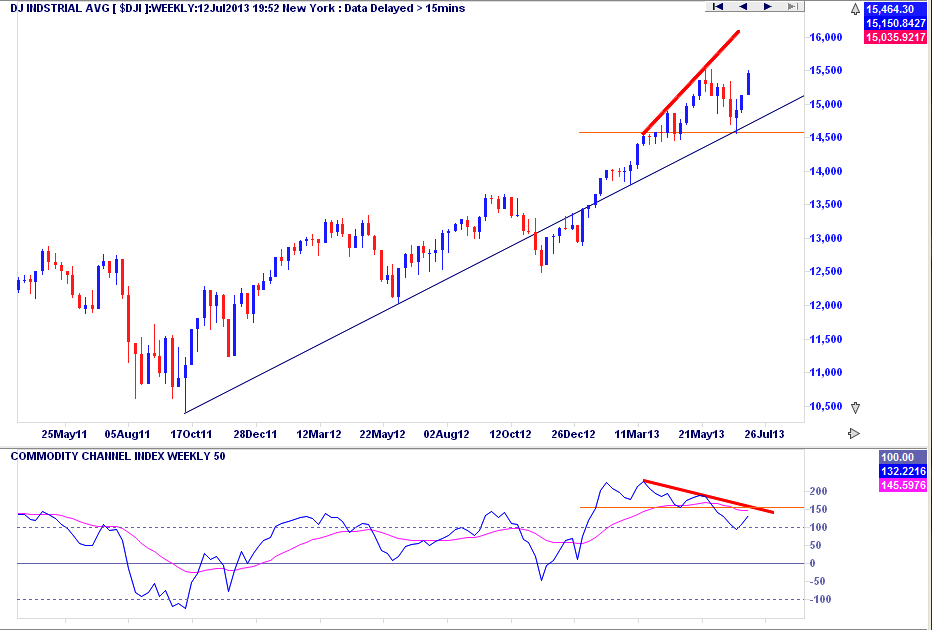

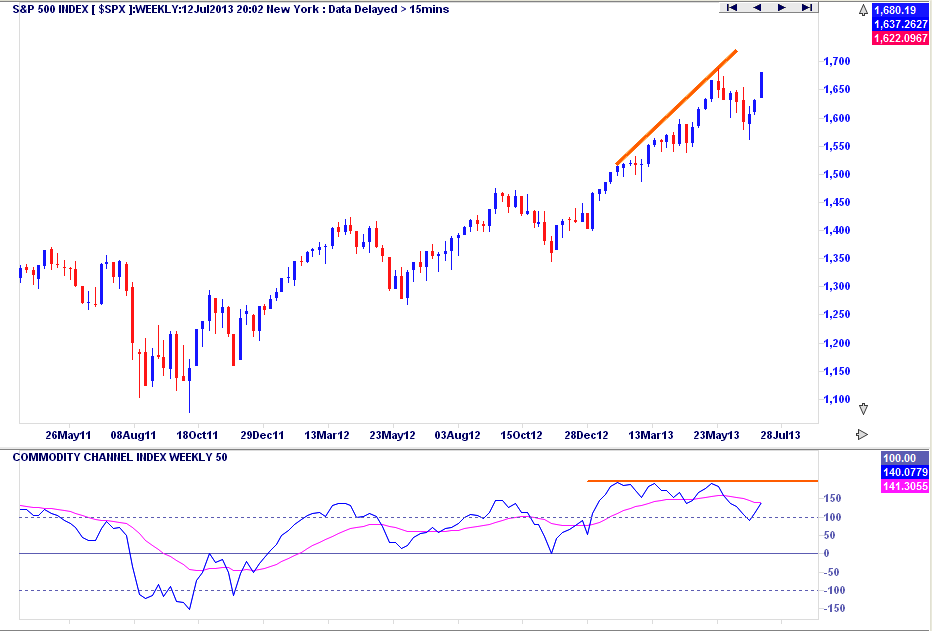

Next we go to the weekly chart. And it's here we see the warning sirens are starting to become quite strident. Divergence between the price and the weekly version of Big Bird became very, very obvious ... and the warning is not simply that Big Bird went down the falling red diagonal while price rode the climbing red diagonal in that timeframe.

You'll see a thin, orange horizontal in both price and oscillator areas. Price came down and turned back up after reaching the level of an earlier consolidation. Big Bird didn't; it plunged through. It did not lose the +100 level, which is near-term Bullish.

But! The warning sirens are going off and week-by-week, they're starting to get a little louder.

You'll see a thin, orange horizontal in both price and oscillator areas. Price came down and turned back up after reaching the level of an earlier consolidation. Big Bird didn't; it plunged through. It did not lose the +100 level, which is near-term Bullish.

But! The warning sirens are going off and week-by-week, they're starting to get a little louder.

In 2007, markets put in a volatile topping pattern from May through to October; in 2011 they plunged during that period. It's a timeframe which needs to be watched carefully - especially if a Bull market top is now being put in place.

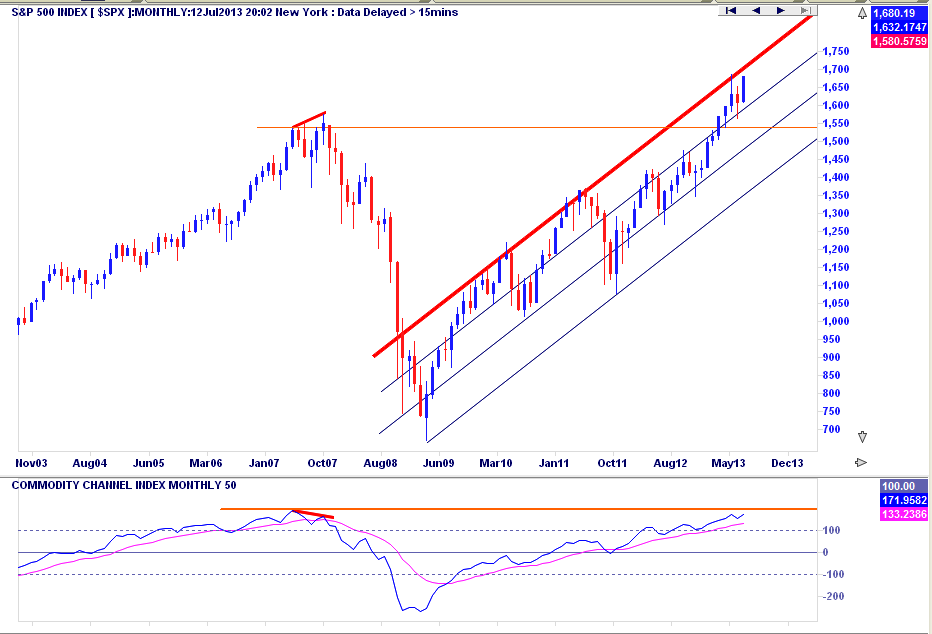

And we can see the potential for that to happen in Pollyanna, the SP500, as well as the DJI. While the Dow nears the top line of the megaphone, Miss Polly is rising again to challenge the top of her channel - a redline barrier with a history of producing sharp price reversals when it's breached.

And we can see the potential for that to happen in Pollyanna, the SP500, as well as the DJI. While the Dow nears the top line of the megaphone, Miss Polly is rising again to challenge the top of her channel - a redline barrier with a history of producing sharp price reversals when it's breached.

Monthly Big Bird has not started to screech horribly in the chart above - though it's still below its 2007 peak, with the price of the index higher. That's not exactly a sweet, clear song.

And weekly Big Bird in the chart below is now getting distinctly unhappy.

And weekly Big Bird in the chart below is now getting distinctly unhappy.

I've been stressing lately that the danger signs are increasing; which doesn't mean that The Top has already been reached. Well, not for Wall Street. I think some other indices have probably arrived at their Bull highs and are now just marking time, waiting for Wall Street to face the reality that printing money to prop-up stock prices is ... "irrational exuberance". Again. Slow learners.

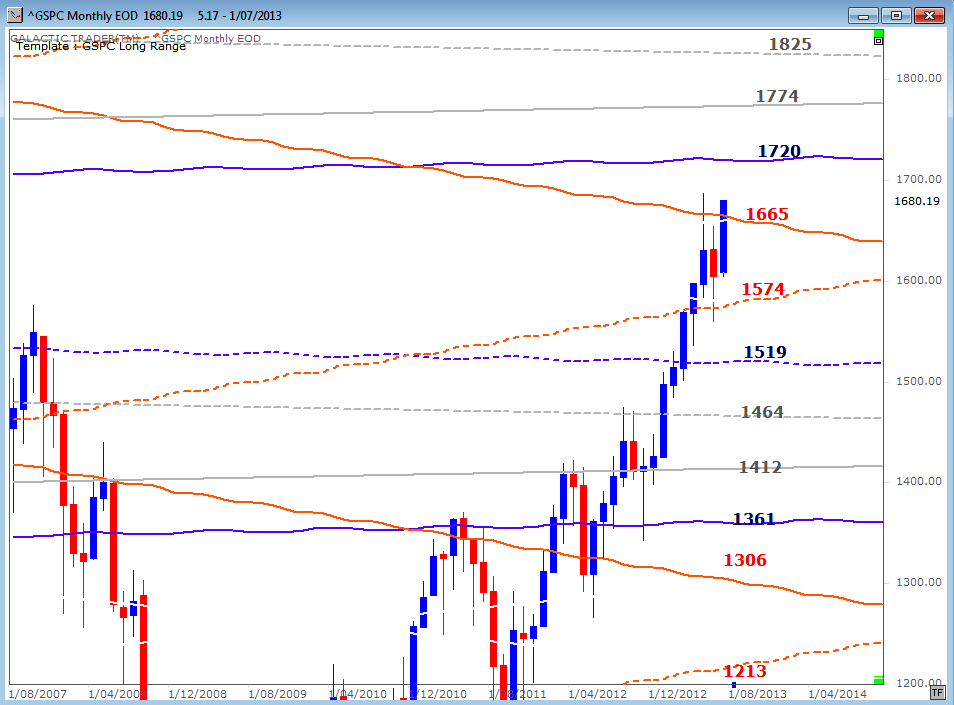

To find out exactly where Miss Pollyanna might top out this Bull run, I do need to turn to The Spooky Stuff ... my long-range planetary price chart for the index.

I had fully expected this run to stop, or at least stall heavily, in the Pluto/Node range from 1519 to 1574. The state of the Birds never did agree with me. As I've said often: astrological expectations never over-ride technical conditions. And they didn't this time, either.

To find out exactly where Miss Pollyanna might top out this Bull run, I do need to turn to The Spooky Stuff ... my long-range planetary price chart for the index.

I had fully expected this run to stop, or at least stall heavily, in the Pluto/Node range from 1519 to 1574. The state of the Birds never did agree with me. As I've said often: astrological expectations never over-ride technical conditions. And they didn't this time, either.

Anyway, the chart above gives three clear potential target areas for the Bull to exhaust himself at. Over the course of the next few weeks, I'll try to update the targets for other indices, including the major Europeans, India and Asia.

Fairly regularly, I update what I call my Weekly Planets charts for various indices - and if you're not taking advantage of them, you're mad. It's really not that hard. You do need to be able to use an oscillator in conjunction with the price targets to know when the technical signals for a turn are obvious.

I had a truly irritating email during the week from someone who asked: "What's an oscillator?" Well, darling, if you're too damn dumb, or too damn lazy, to spend a few minutes going through these FREE weekly reports, don't waste my bloody time.

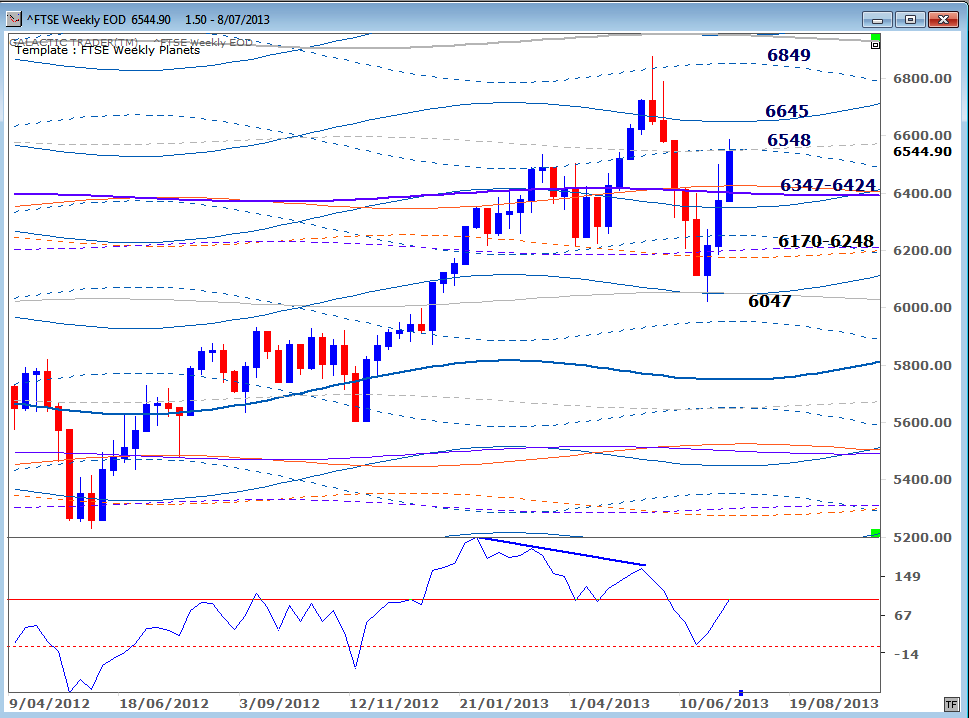

For those of you do read and seek to learn - and that, I know, is about 99.98% of readers - here's a quick how-to using the FTSE WP and ASX200 WP charts.

Given the level of negative divergence in the Big Bird as the FTSE temporarily breached the 6849 level, it was a fairly safe place to Short that index. There was no early positive divergence signal as the index breached 6047, though the rapid recovery did indicate it was a reasonable place to go Long again

Fairly regularly, I update what I call my Weekly Planets charts for various indices - and if you're not taking advantage of them, you're mad. It's really not that hard. You do need to be able to use an oscillator in conjunction with the price targets to know when the technical signals for a turn are obvious.

I had a truly irritating email during the week from someone who asked: "What's an oscillator?" Well, darling, if you're too damn dumb, or too damn lazy, to spend a few minutes going through these FREE weekly reports, don't waste my bloody time.

For those of you do read and seek to learn - and that, I know, is about 99.98% of readers - here's a quick how-to using the FTSE WP and ASX200 WP charts.

Given the level of negative divergence in the Big Bird as the FTSE temporarily breached the 6849 level, it was a fairly safe place to Short that index. There was no early positive divergence signal as the index breached 6047, though the rapid recovery did indicate it was a reasonable place to go Long again

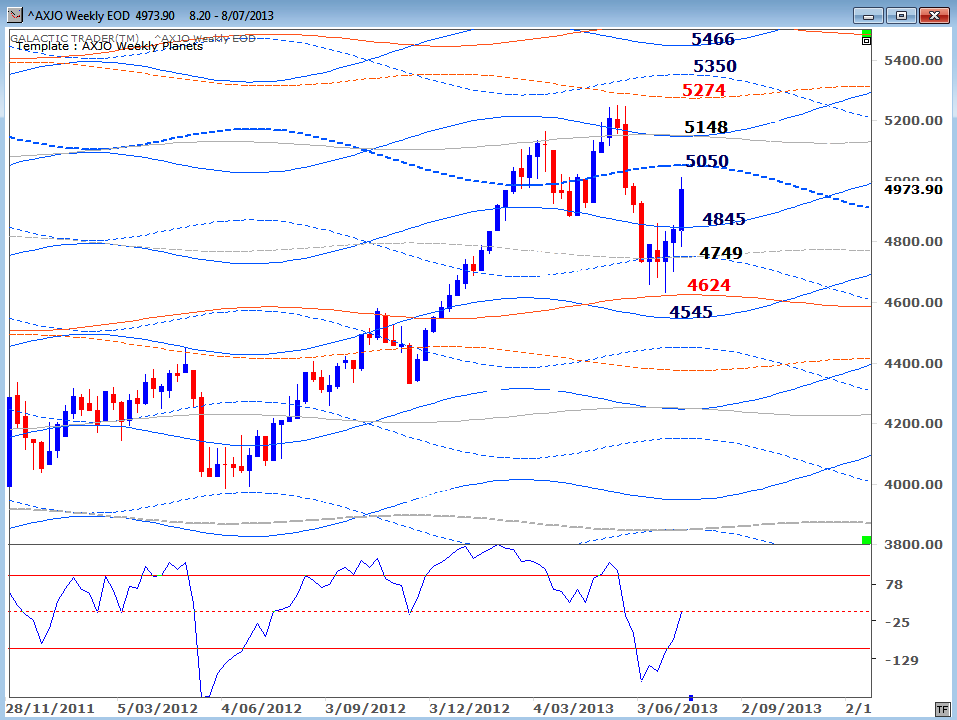

It was pretty much a case of "ditto" for the 200, where there was oscillator divergence at the price high and a small case of positive divergence at the price low.

Remember these are weekly charts and the dailies can be used for fine-tuning Entry and Exit points ... Just as I did earlier in the Dow charts. The quarterly shows the danger signs starting, but not strident ... while the weekly shows just how strongly the klaxons are starting to growl.

Using the Weekly Planets charts for intermediate-range moves is just a variation. They set the potential targets, but you use daily charts to tell you whether your anticipated trade is ready for Entry or Exit. And once the move starts, in either direction, you have ideal prices to use as the base for Loss Stop provisions.

Remember these are weekly charts and the dailies can be used for fine-tuning Entry and Exit points ... Just as I did earlier in the Dow charts. The quarterly shows the danger signs starting, but not strident ... while the weekly shows just how strongly the klaxons are starting to growl.

Using the Weekly Planets charts for intermediate-range moves is just a variation. They set the potential targets, but you use daily charts to tell you whether your anticipated trade is ready for Entry or Exit. And once the move starts, in either direction, you have ideal prices to use as the base for Loss Stop provisions.

Okay, that's a wrap for this weekend. Frankly, I have no idea what the short-term direction is ... and I believe Benign Ben is due to make an appearance before the House this week. Personally, I live in dread anytime Ben is presented with an opportunity to "clarify" the Fed's current position!