On countdown for a trend change

Week beginning January 21, 2013

World stock indices are pushing higher as we head into a potential critical trend change date late this week or early next.

Copyright: Randall Ashbourne - 2011-2013

And that was true intramarket as well as intermarket. The Dow Jones Transports and the SP500 ripped north, while the DJIA and the NDX remain below the level of last September's peaks.

Some other indices are running into planetary barriers; in some cases with positive signals from the oscillators and others displaying intermediate-term negative divergence.

Gold, so far, is playing by planetary prices and lunar phase trades detailed in Forecast 2013.

Last weekend, I published Weekly Planets Charts for the FTSE, TSX60, India's Nifty and Singapore's STI. We'll look at a different set this weekend. Go to the link button at the bottom of this edition if you need to refresh your memory on the price targets for those 4 indices.

Some other indices are running into planetary barriers; in some cases with positive signals from the oscillators and others displaying intermediate-term negative divergence.

Gold, so far, is playing by planetary prices and lunar phase trades detailed in Forecast 2013.

Last weekend, I published Weekly Planets Charts for the FTSE, TSX60, India's Nifty and Singapore's STI. We'll look at a different set this weekend. Go to the link button at the bottom of this edition if you need to refresh your memory on the price targets for those 4 indices.

The Venus transit to the Uranus/Pluto square configuration has moved us from the cliff to the ceiling, with the Republicans planning to introduce a Bill this week to daub it with a little feel-good fresco to keep everyone on tenterhooks for another three months.

A lot of markets hit new multi-year highs last week ... and some did not.

A lot of markets hit new multi-year highs last week ... and some did not.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

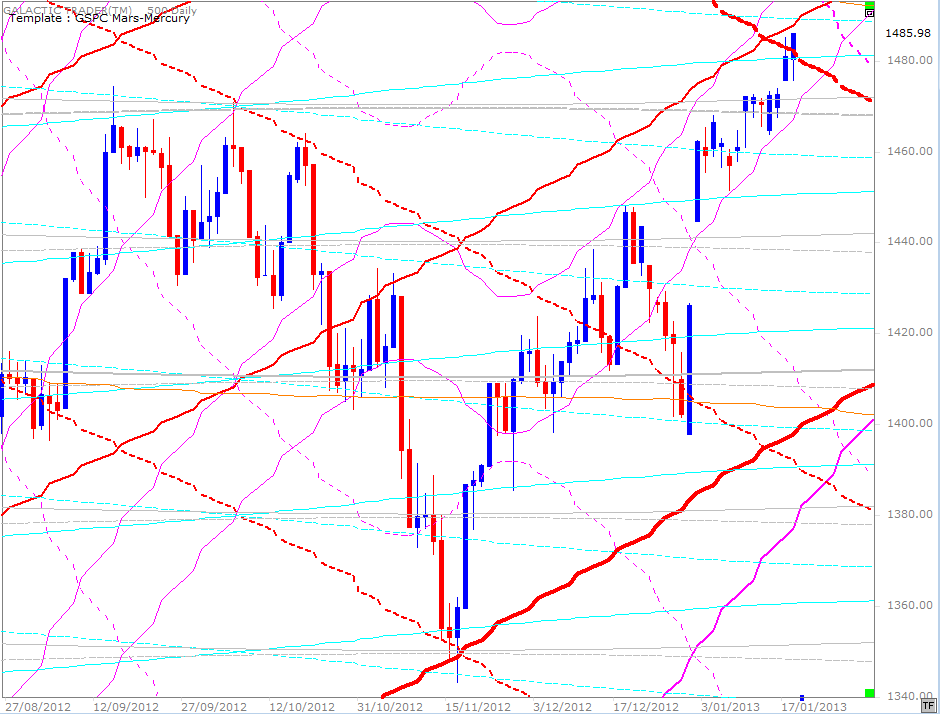

I indicated last weekend that the 500 was basing on top of an important planetary price line at 1468 and that opened a new target in the 1480s.

A late rush on Friday pushed the 500 right into the 1480s range and may have overstepped the mark by breaking a key Mars line. I said last week the key action days were likely to be Wednesday and Thursday ... and Thursday brought another Open gap, the second time in the past three weeks that the big boys' computers have forced up prices in the overnight session.

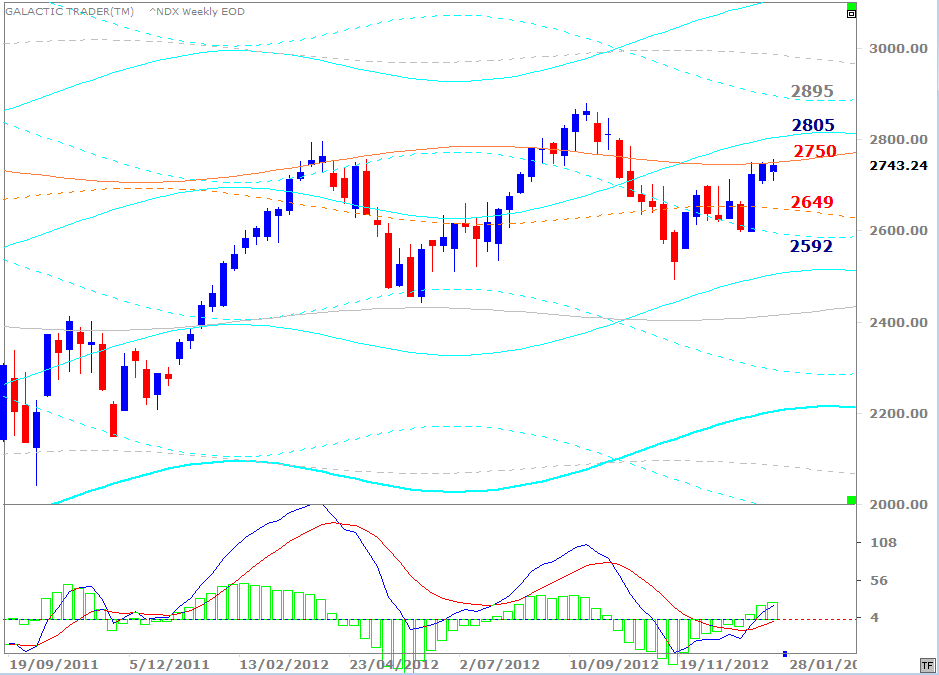

The Nasdaq 100, however, continues to display relative weakness ...

The Nasdaq 100, however, continues to display relative weakness ...

This is the third week the NDX recovery has been stalled by a Uranus line and the danger remains the tech index is still forming the right shoulder of a H&S pattern with a sharp downside if it plays out.

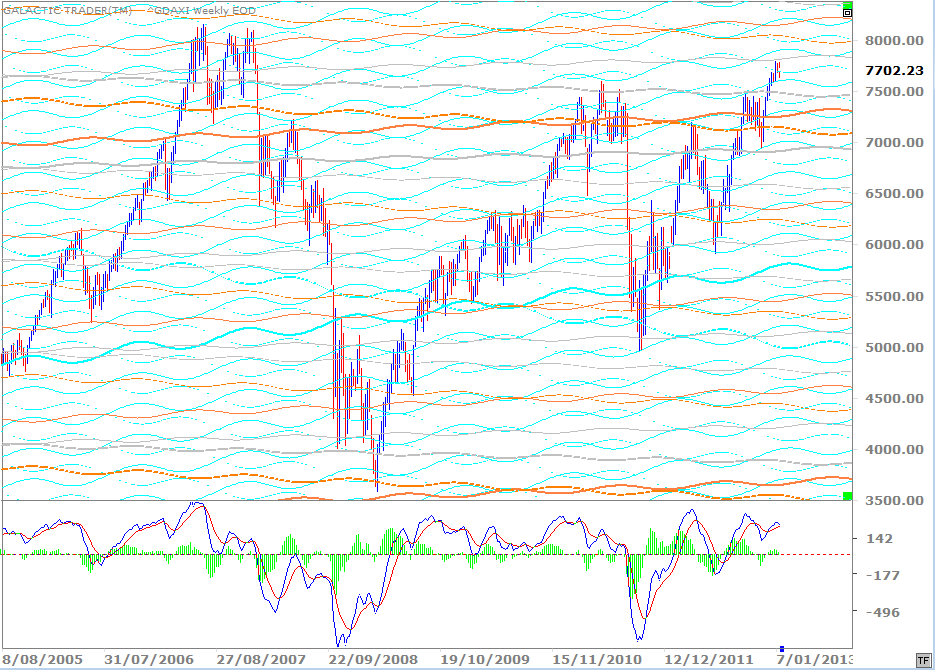

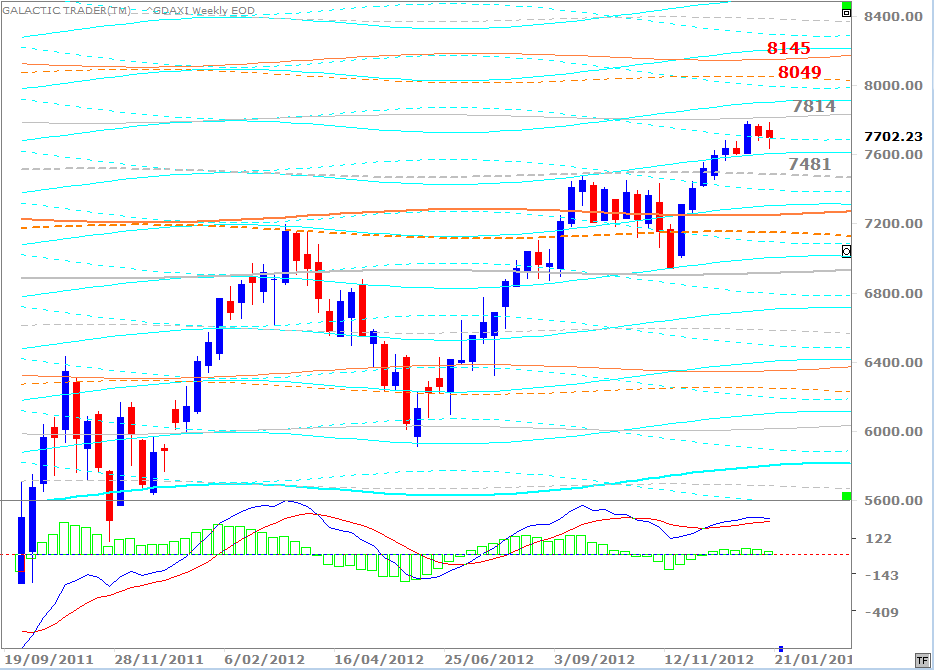

Germany's DAX is one of the European indices which failed to breakout last week, though the reality is it actually made its breakout 7 weeks ago ... and is stalling at a very high level of recovery.

Germany's DAX is one of the European indices which failed to breakout last week, though the reality is it actually made its breakout 7 weeks ago ... and is stalling at a very high level of recovery.

The chart above shows the index within a double Neptune zone which was important during the topping process in 2007. Negative divergence in the fast MACD is obvious; not only are the signal peaks declining, but so is the height of the histogram peaks.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

NEW:

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

The chart above provides more detail. The Neptune zone now extends from 7480 to 7814. Saturn lines are underpinning the declines ... so far ... but the DAX is having trouble breaking above the Neptune level.

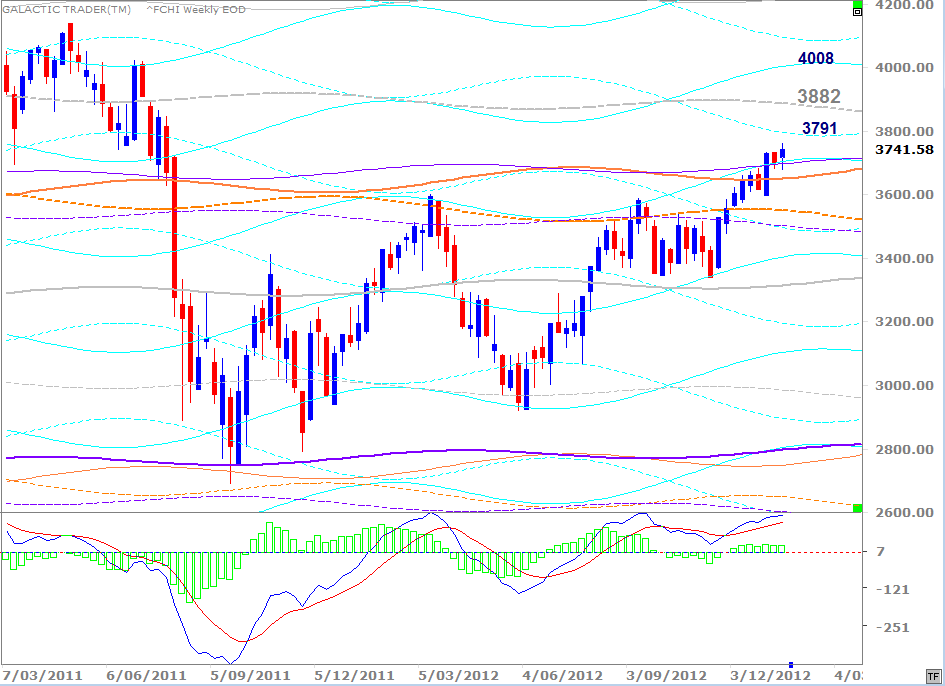

The CAC30 has made it through a Uranus zone and is trying to maintain strength on top of a Pluto/Saturn price zone. The critical target is probably the primary Neptune, currently priced in the 3880s. Trace that line back and you'll see a gap in the price bars.

The French index may be on a mission to fill it.

The French index may be on a mission to fill it.

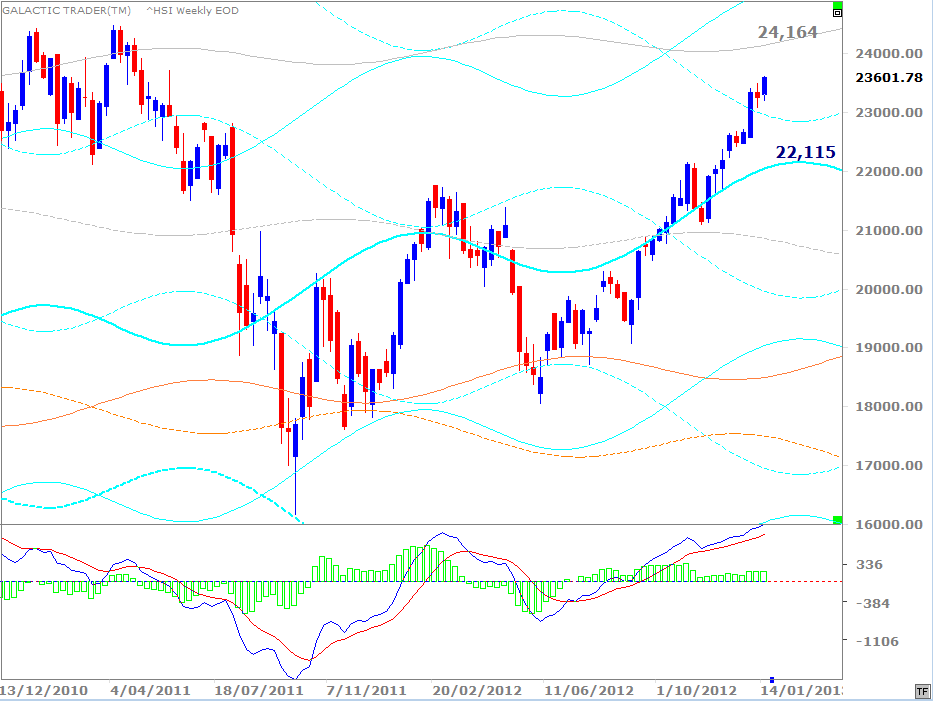

The Hang Seng, of Hong Kong, had a good week. There is divergence in the height of the histograms, but nothing obvious in the MACD signal lines to get unduly concerned about for the moment.

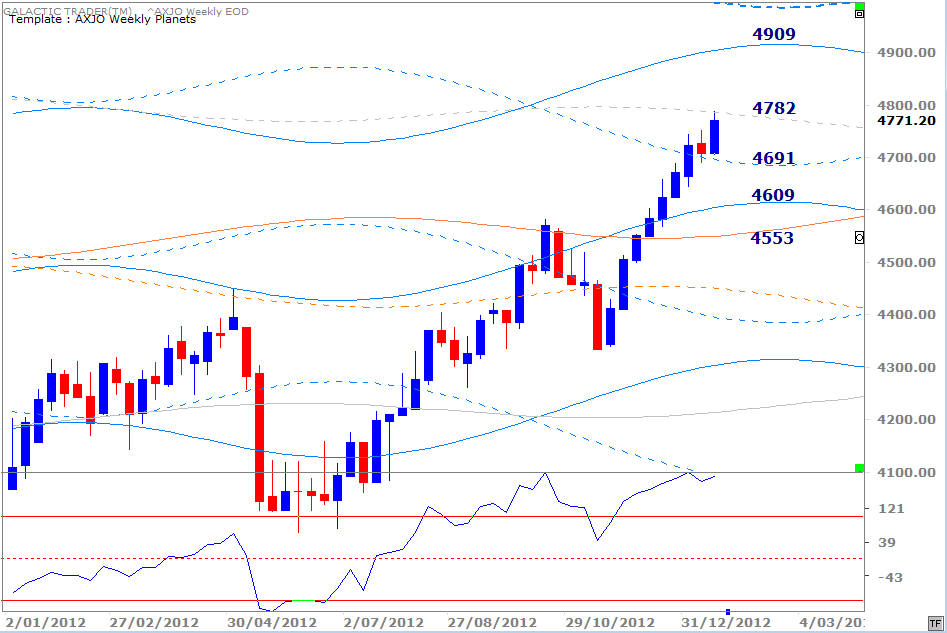

The ASX200, above, continues to behave in very predictable fashion. The price of that planetary line was listed last weekend as 4785 and the index went a tad above 4787 before backing off.

I still haven't set up an Archives page for this year's old Eyes. Until I do, you can reach them from the dated buttons below.