The grind-and-churn continues

Week beginning February 27, 2012

Nothing much happened. The bump-and-grind goes on as markets head towards their date with Destiny.

Copyright: Randall Ashbourne - 2011-2012

Venus in Taurus is at her best. She's still in Aries ... in bitch mode. But, as this week ends, she moves on into her own first sign, Taurus, for a steaming kissy/smoochy with Jupiter. Taurus is sensual, luxuriant. If it feels good, do it. And do it. And then, do it again. Because Taurus also has stamina and there can never be too much of a good thing.

It's also stubborn - and a Venus/Jupiter conjunction in Taurus really is when the irresistible force meets the immovable object. But, this once in a dozen years Toro tryst, between the centrefold seductress and the randy old bugger who used to turn into a Bull to seduce any regal babes who caught his wandering eye, has a couple of voyeurs.

The Venus-Jupiter conjunction is trined to both Mars and Pluto. Venus and Mars always had a "thing" ... Ploots had an unrequited "thing" going for Venus ... which got the Marshun aggro going. Oh, tsk* ... the family scandals of an Olympian soap opera!

What it means is ... why I think it's the first real date of importance of the year ... is that it's highly likely to be The Climax of a high-energy charge that has been building for a long time. In my opinion/interpretation of The Spooky Stuff.

It's also stubborn - and a Venus/Jupiter conjunction in Taurus really is when the irresistible force meets the immovable object. But, this once in a dozen years Toro tryst, between the centrefold seductress and the randy old bugger who used to turn into a Bull to seduce any regal babes who caught his wandering eye, has a couple of voyeurs.

The Venus-Jupiter conjunction is trined to both Mars and Pluto. Venus and Mars always had a "thing" ... Ploots had an unrequited "thing" going for Venus ... which got the Marshun aggro going. Oh, tsk* ... the family scandals of an Olympian soap opera!

What it means is ... why I think it's the first real date of importance of the year ... is that it's highly likely to be The Climax of a high-energy charge that has been building for a long time. In my opinion/interpretation of The Spooky Stuff.

It's a big event up in the party room of the Old Gods - and is the reason I nominated it as the first of my probable major turn dates for the year.

I've outlined in Forecast 2012 the detailed history of markets tending to peak with Jupiter in early degrees of Taurus. We are now entering the timeframe where the FatBoy will be joined by Venus.

I've outlined in Forecast 2012 the detailed history of markets tending to peak with Jupiter in early degrees of Taurus. We are now entering the timeframe where the FatBoy will be joined by Venus.

Now, I know the emails didn't stop ... that far too many of you spent far too much time talking, listening and searching for "meaning" in the entrails of the daily squiggles ... and that you're feeling frustrated and frenzied.

Puhleeze! Get a grip. Nothing happened. And probably nothing big is going to happen until we hit the dénouement around March 14.

Technically, the "pattern" still doesn't look complete to me. I still think that what should happen is a quick correction followed by a final exhaustion thrust - and then the start of a long-term dive.

IF markets are actually falling hard into that date, I will probably have to go back to the drawing board. However, for the moment, the broad gameplan is still in play - even if the Wall Street indices have recovered higher than I'd expected was likely.

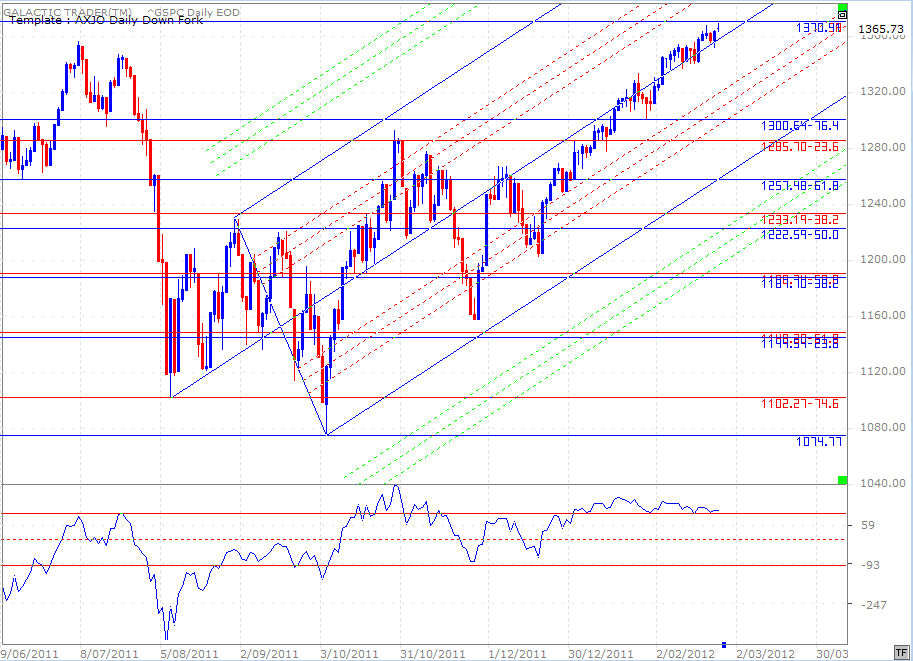

SP500:

Technically, the "pattern" still doesn't look complete to me. I still think that what should happen is a quick correction followed by a final exhaustion thrust - and then the start of a long-term dive.

IF markets are actually falling hard into that date, I will probably have to go back to the drawing board. However, for the moment, the broad gameplan is still in play - even if the Wall Street indices have recovered higher than I'd expected was likely.

SP500:

Pollyanna is maintaining contact with the central tyne of a rising pitchfork based at the bottoming process of the sudden decline last year ... and the grind-and-churn just below the level of the 2011 High is obvious.

As I've been indicating for a few weeks, there is nothing in the oscillators screeching a danger signal and this sort of slow-grind rally can be maintained longer than pure exhaustion runs. You'll note the tricks here ... the one-day intervention Big Blue Bars, followed by a few days of smaller gains.

The level of the previous High is hard to break. I suspect it will actually be broken as a "false break" pattern. We need to keep monitoring the pattern and the oscillators to get a better idea of whether to throw out the old gameplan.

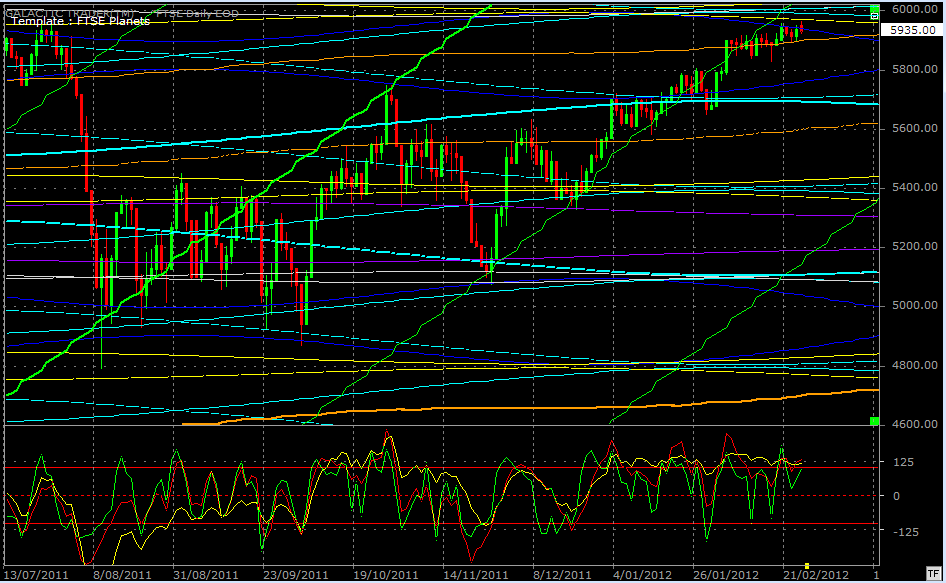

While we can see the technical significance of the overhead Resistance on the SP500, we can see the same thing in planetary price terms on the London Exchange.

FTSE100:

As I've been indicating for a few weeks, there is nothing in the oscillators screeching a danger signal and this sort of slow-grind rally can be maintained longer than pure exhaustion runs. You'll note the tricks here ... the one-day intervention Big Blue Bars, followed by a few days of smaller gains.

The level of the previous High is hard to break. I suspect it will actually be broken as a "false break" pattern. We need to keep monitoring the pattern and the oscillators to get a better idea of whether to throw out the old gameplan.

While we can see the technical significance of the overhead Resistance on the SP500, we can see the same thing in planetary price terms on the London Exchange.

FTSE100:

There'll be a chart of the FTSE Weekly Planets not too far back in the Archives you can check to see why there's strong Resistance around the 6000 level on the index ... but the cluster of planetary lines is also obvious on the chart above.

The only danger in both examples is that it actually is high-level accumulation and not a persistent game by the computers to keep prices high while the big boys unload their holdings. Still, while it continues to play into the March timeframe I've talked about for so long now, I'll continue leaning towards the latter interpretation unless and until it's proven to be wrong.

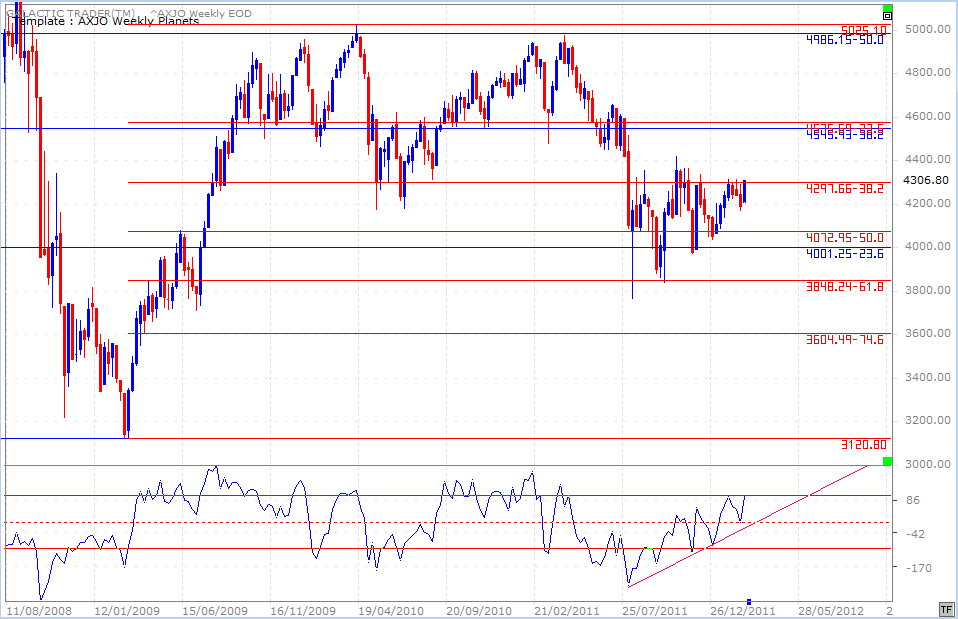

ASX200:

The only danger in both examples is that it actually is high-level accumulation and not a persistent game by the computers to keep prices high while the big boys unload their holdings. Still, while it continues to play into the March timeframe I've talked about for so long now, I'll continue leaning towards the latter interpretation unless and until it's proven to be wrong.

ASX200:

This is Auntie's weekly and is the same chart I've shown for a couple of weeks, explaining she was playing Fibolin strings. We now have only the second close above this level since the first rally out of the TAS Low in October.

There is no disagreement from the long-term Canary, so this break above the Fibonacci level just might be real. It would be a damn sight easier to have confidence in that call if it were not for the statistical negativity of the current Moods of the Moon phase - heading into 1Q.

The Old Gods' Taurean party is looming, and a long-term meeting between the two Benefics, in Venus's favorite sign, has a lot more oomph than a Lunar phase.

I suspect we'll see a bump in volatility this week. A lot of the action is going to take place with the Moon in Gemini. It's similar to the Moon in Sagittarius ... an increased likelihood of wide-range days. But, in Gemini, the range tends to go both ways.

But, there is other Spooky Stuff happening, too. As we head towards the end of the week, the Sun will oppose Mars; Venus, still in late Aries, will oppose Saturn; and Mercury will move to Aries to conjunct Uranus early in the following week.

The Sun in opposition to Mars symbolically fires-up the action and the Venus opposition to Saturn suggests at least a temporary roadblock in the middle of the money trail ... before yet another major mood change among the Old Gods as Venus and Jupiter meet up in Taurus.

Y'know of course that Taurus is the sign of the Bull. Mars is action. Pluto is Big Money ... and manipulation on a massive scale. If one were looking for The Climax of a Bullish recovery run, the few days around March 14 look like "it".

And I really don't see any point in continuing to waffle on about it. We need to let it play out ... see if it actually confirms our expectations ... and keep close watch on both the pattern and the oscillators.

There is no disagreement from the long-term Canary, so this break above the Fibonacci level just might be real. It would be a damn sight easier to have confidence in that call if it were not for the statistical negativity of the current Moods of the Moon phase - heading into 1Q.

The Old Gods' Taurean party is looming, and a long-term meeting between the two Benefics, in Venus's favorite sign, has a lot more oomph than a Lunar phase.

I suspect we'll see a bump in volatility this week. A lot of the action is going to take place with the Moon in Gemini. It's similar to the Moon in Sagittarius ... an increased likelihood of wide-range days. But, in Gemini, the range tends to go both ways.

But, there is other Spooky Stuff happening, too. As we head towards the end of the week, the Sun will oppose Mars; Venus, still in late Aries, will oppose Saturn; and Mercury will move to Aries to conjunct Uranus early in the following week.

The Sun in opposition to Mars symbolically fires-up the action and the Venus opposition to Saturn suggests at least a temporary roadblock in the middle of the money trail ... before yet another major mood change among the Old Gods as Venus and Jupiter meet up in Taurus.

Y'know of course that Taurus is the sign of the Bull. Mars is action. Pluto is Big Money ... and manipulation on a massive scale. If one were looking for The Climax of a Bullish recovery run, the few days around March 14 look like "it".

And I really don't see any point in continuing to waffle on about it. We need to let it play out ... see if it actually confirms our expectations ... and keep close watch on both the pattern and the oscillators.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)