Wall Street hits New Moon high point

Week beginning February 11, 2013

Now ... right now ... is probably a good time to consider being very, very cautious.

Copyright: Randall Ashbourne - 2011-2013

In a few moments, we'll take another look at the big picture for the SP500. The index managed to grab the fistful of dollars I mentioned last weekend and Friday's price action took the Pollyanna index within mere cents of the long-range planetary line which topped out the two previous Bull peaks.

Monday kicks off on Wall Street with Venus squaring Saturn, a strong negative aspect with the potential to reinforce the trend-turning power of last week's Mars/Neptune conjunction.

And we enter the two-week lunar phase between New Moon and Full Moon, which has a statistical tendency over the long haul of moving markets downwards.

If a correction does start to develop now, it's probably not the start of a big one.

But, it probably is time to start thinking very seriously about protecting your capital.

Monday kicks off on Wall Street with Venus squaring Saturn, a strong negative aspect with the potential to reinforce the trend-turning power of last week's Mars/Neptune conjunction.

And we enter the two-week lunar phase between New Moon and Full Moon, which has a statistical tendency over the long haul of moving markets downwards.

If a correction does start to develop now, it's probably not the start of a big one.

But, it probably is time to start thinking very seriously about protecting your capital.

American markets have been rising into the Aquarian New Moon, with Pollyanna hitting 5 year highs on Friday and the Nasdaq Composite hitting a 12-year high.

But key indices in Europe and Asia went in the opposite direction last week.

But key indices in Europe and Asia went in the opposite direction last week.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Let's take a look first at the 500's long-range chart ...

As I mention in the book, every stock and every index will display a long-term tendency to repeat the same angles of rally and decline over and over again. In the chart above, I've inserted a trendline linking the Bear bottom in 2009 with the countertrend low of late 2011 ... and then taken a parallel of that trendline and applied it to the two previous Bull runs.

The current run has more in common with the blow-off into the 2000 peak, rather than the 2007. Not only is Pollyanna now within the price range of a potential triple top formation, but the big bird Canary is warning of potential negative divergence. It continues to hold on top of the +100 level, so we cannot be certain at this stage that the rally cannot go further over the remainder of the year.

In fact, the weekly charts says higher prices are probable, rather than merely possible.

The current run has more in common with the blow-off into the 2000 peak, rather than the 2007. Not only is Pollyanna now within the price range of a potential triple top formation, but the big bird Canary is warning of potential negative divergence. It continues to hold on top of the +100 level, so we cannot be certain at this stage that the rally cannot go further over the remainder of the year.

In fact, the weekly charts says higher prices are probable, rather than merely possible.

Make note of the difference between the long-range oscillator on the weekly chart, compared with the monthly chart. What we ideally want to see before shifting from caution mode to Get the Hell out of Dodge mode is a higher price peak accompanied by a lower oscillator peak ... and there's no sign of that yet.

However, when we divide that trendline from the first chart into a channel on the weekly version, we can see why the resistance is diagonal, as well as horizontal.

Too, there is the continued under-performance of the Nasdaq 100, which is not as optimistic as the Composite. Of course, we can blame Apple. However, it's never a good idea to single out a scapegoat. When we look at multi-year charts, they're just charts and nobody ever remembers what piece of "news" caused this or that turn up or down.

However, when we divide that trendline from the first chart into a channel on the weekly version, we can see why the resistance is diagonal, as well as horizontal.

Too, there is the continued under-performance of the Nasdaq 100, which is not as optimistic as the Composite. Of course, we can blame Apple. However, it's never a good idea to single out a scapegoat. When we look at multi-year charts, they're just charts and nobody ever remembers what piece of "news" caused this or that turn up or down.

The NDX closed for the second week above the Uranus barrier which has been holding it back for over a month. A look at the daily suggests those closes are not quite as strong as they appear to be.

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

NEW:

Forecast 2013 is now available for sale and download.

Click the button on the right for more details.

Click the button on the right for more details.

The Uranus barrier is in yellow on the NDX daily chart above and the positive weekly closes are the result of Friday bumps ... with the last one showing a clear gap to get it above the line. However, unless there's some more boosting early Monday, the index runs the risk of being turned down by a falling Sun line (the dashed, light-green line).

If you track the history of those falling lines in recent months, they do have a distinct tendency to force a correction.

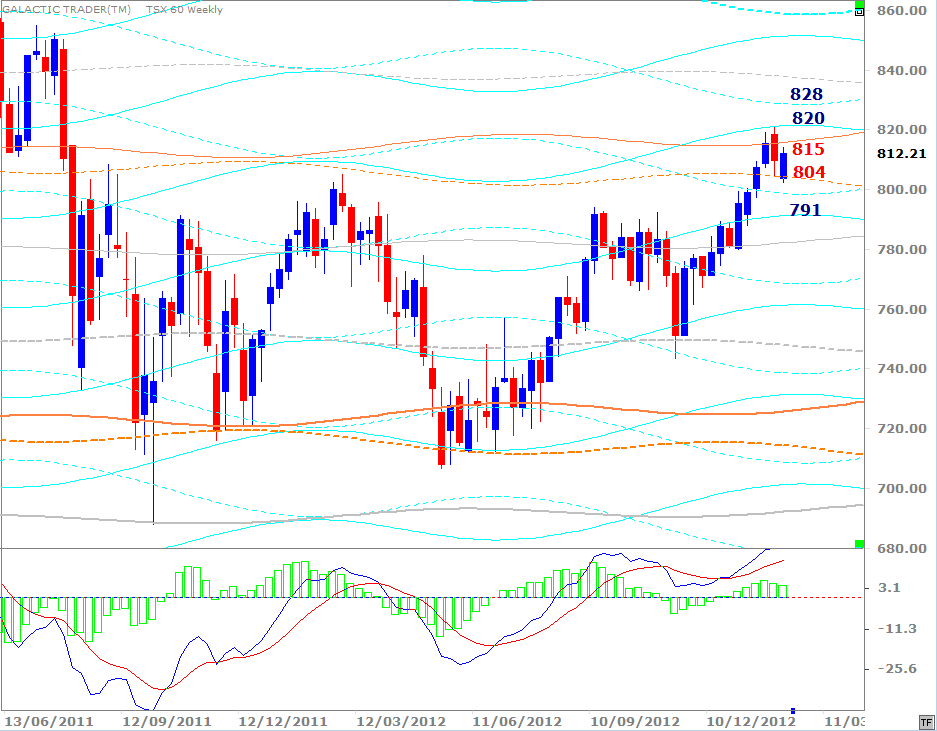

Canada:

If you track the history of those falling lines in recent months, they do have a distinct tendency to force a correction.

Canada:

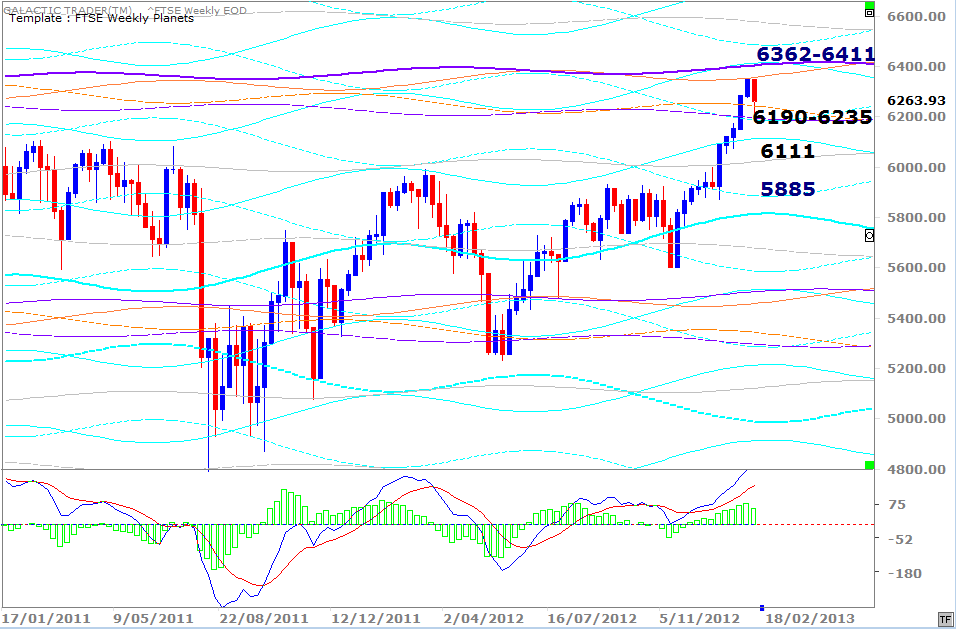

Canada's TSX60 (capped) topped-out the previous week ... as did London's FTSE.

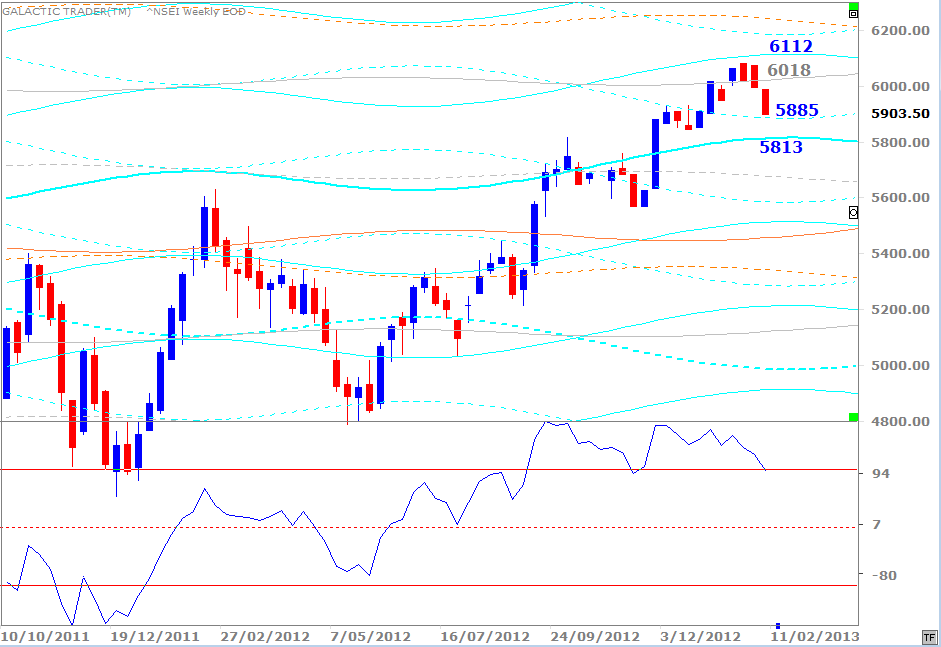

Mumbai's Nifty hit its high three weeks ago ...

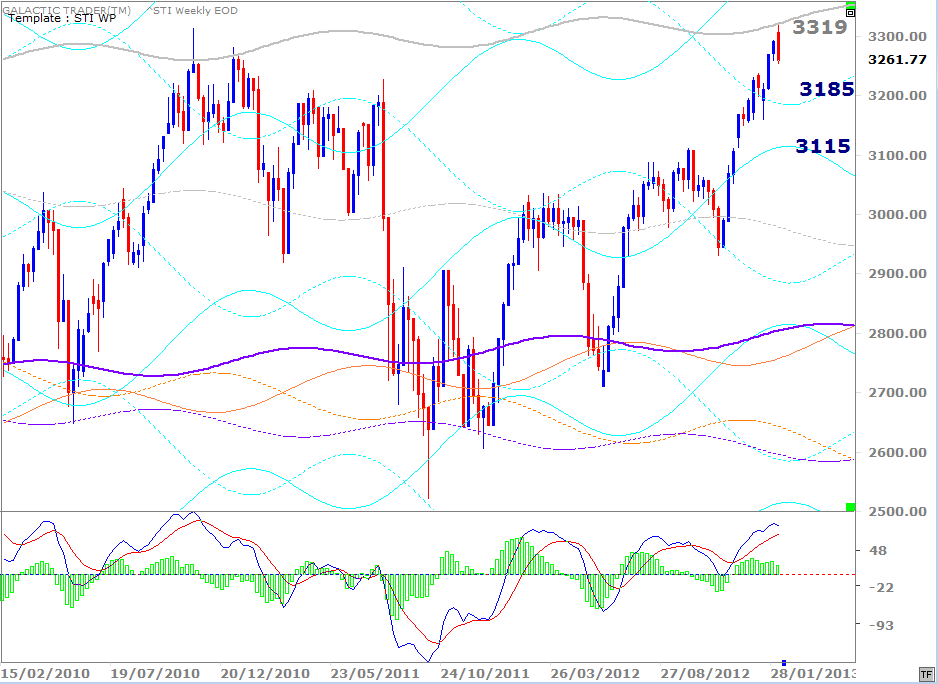

While the Straits Times Index of Singapore made a precise touch last Monday of the Neptune line price at 3919, which we've had as a target since the beginning of the year.

The ASX200 chart below shows that index getting very close to one of its weekly planets targets, as well ... in this case, a primary Saturn unlikely to be easily broken.