Warning signs of an intermediate drop

Week beginning August 27, 2012

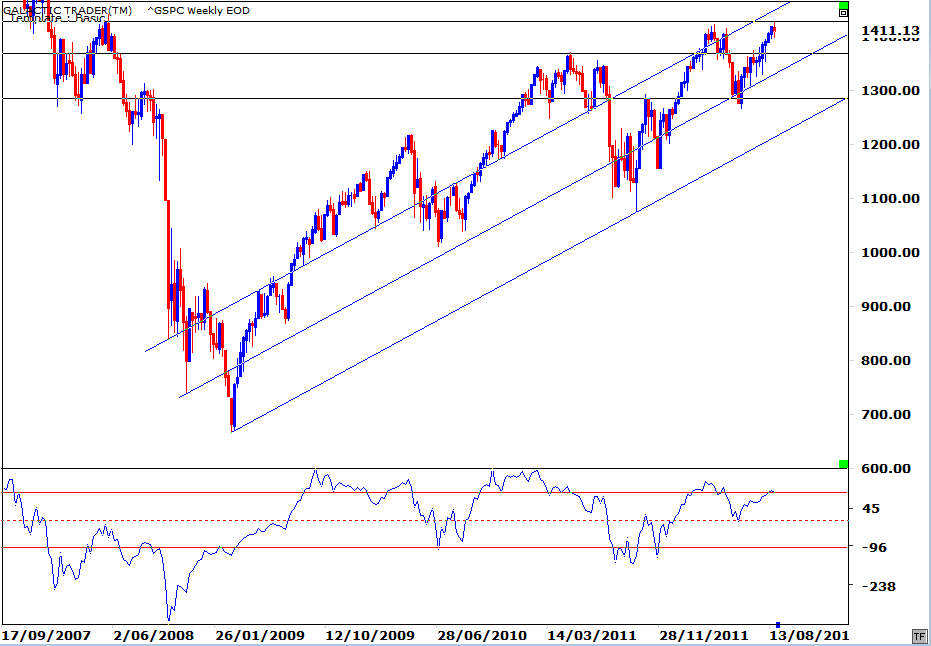

Oscillators on weekly charts are starting to diverge clearly from the price action as the Fed-spooned Wall Street indices knock their head against overhead resistance.

Copyright: Randall Ashbourne - 2011-2012

We will go through a relatively simple exercise this weekend, reviewing Weekly Planets charts for the major indices and check the condition of the planetary downdraft warning in the FTSE I mentioned last weekend.

In terms of The Spooky Stuff, we have another planetary sign change, following the Sun's shift from gambling Leo to analytical and critical Virgo. It's more significant because it involves the action planet, Mars, moving out of Libra and into its own second sign, Scorpio.

Mars in Libra is a diplomat - a velvet glove without the iron fist inside. Mars in Scorpio is ruthless, relentless and totally unforgiving. The change is likely to have a strong impact in a number of mundane areas.

I doubt anyone thinks the language between the Obama and Romney camps has been all that diplomatic, but what is to come will make it seem so. Then there's Bundesbank versus ECB and Israel/Iran.

With Mars gone from Libra, we will see more "scorched earth" aggression taking centre stage.

In terms of The Spooky Stuff, we have another planetary sign change, following the Sun's shift from gambling Leo to analytical and critical Virgo. It's more significant because it involves the action planet, Mars, moving out of Libra and into its own second sign, Scorpio.

Mars in Libra is a diplomat - a velvet glove without the iron fist inside. Mars in Scorpio is ruthless, relentless and totally unforgiving. The change is likely to have a strong impact in a number of mundane areas.

I doubt anyone thinks the language between the Obama and Romney camps has been all that diplomatic, but what is to come will make it seem so. Then there's Bundesbank versus ECB and Israel/Iran.

With Mars gone from Libra, we will see more "scorched earth" aggression taking centre stage.

So far, monthly charts are not giving the same clear warning signs, which would point to a major collapse.

But the fact it's happening on weekly charts indicates there is an increased risk of at least an intermediate-term decline developing.

But the fact it's happening on weekly charts indicates there is an increased risk of at least an intermediate-term decline developing.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

The fast MACD is starting to fade. However, there is a much clearer level of negative divergence showing in the long-range Canary on the SP500.

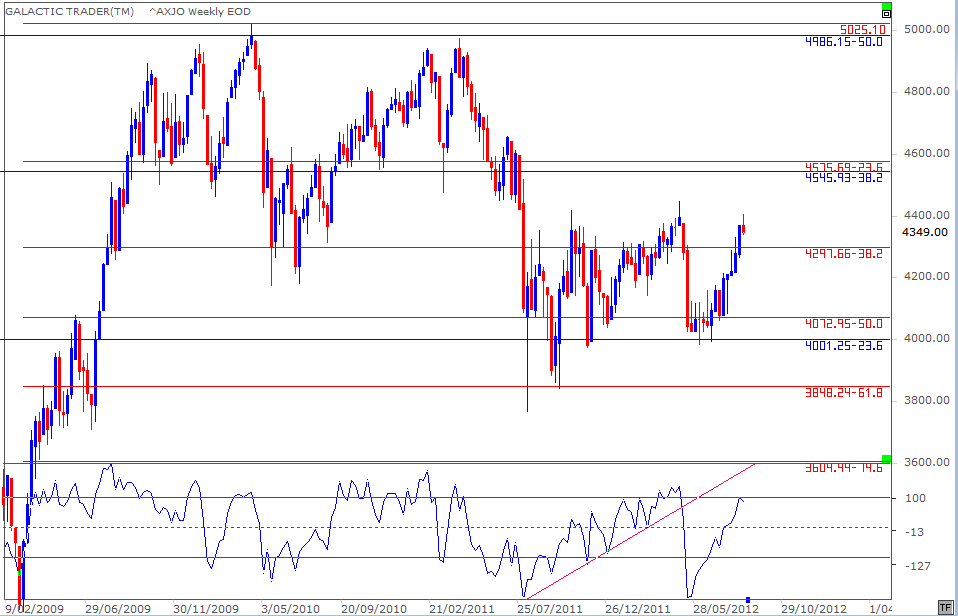

I updated this chart a couple of weekends ago, when I added a third black horizontal technical barrier. Predictably, Pollyanna was turned down from that level last week ... and it happened with negative divergence in the oscillator, something we'd discussed was likely to occur.

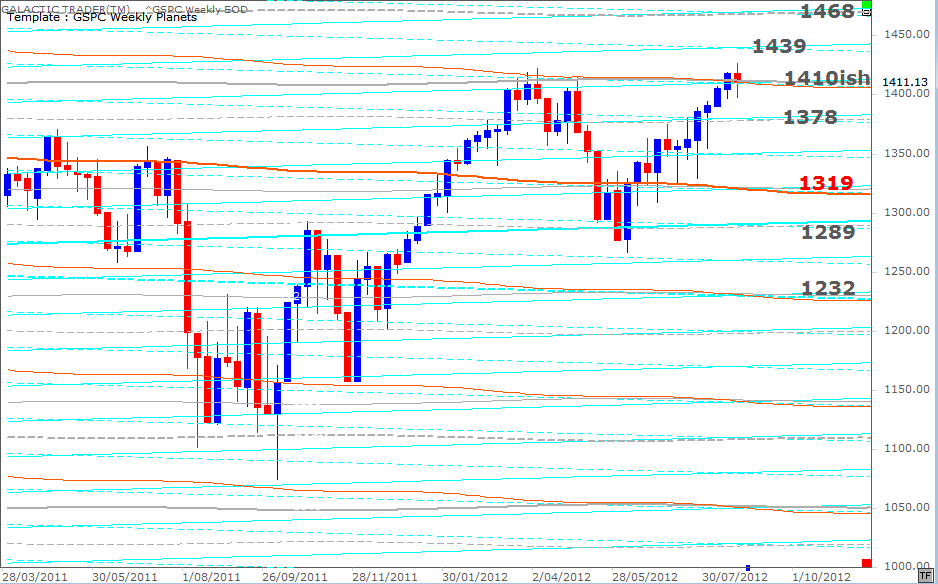

It is a significant divergence and raises the odds of bringing on a decline measured in weeks, rather than days. The 500's Weekly Planets targets are listed in the chart below.

It is a significant divergence and raises the odds of bringing on a decline measured in weeks, rather than days. The 500's Weekly Planets targets are listed in the chart below.

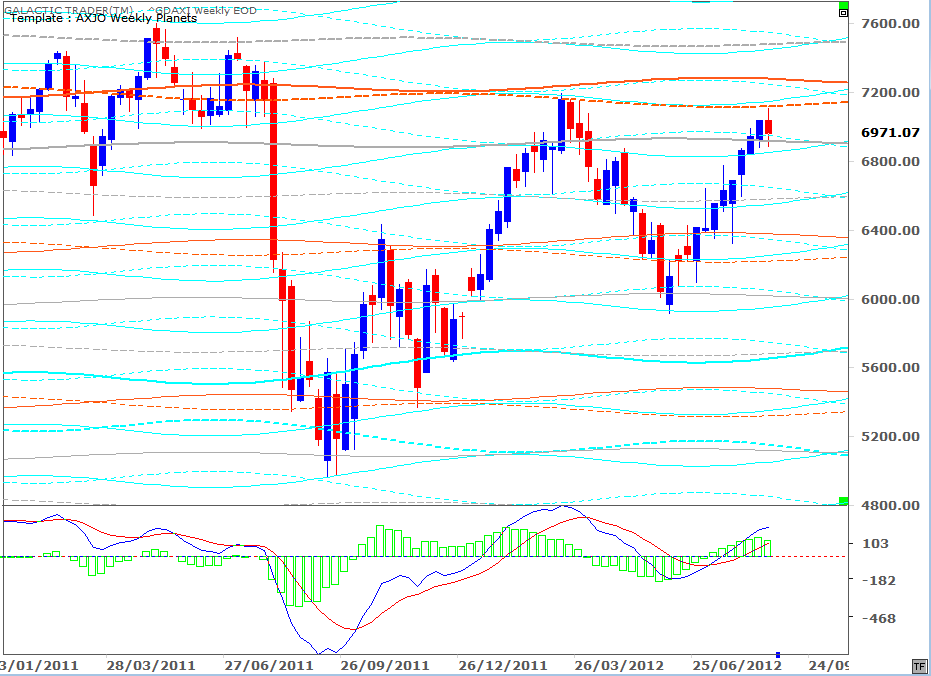

Last weekend, I used WP charts for the German DAX and Indian Nifty. Of the DAX, I said: "... it would appear as though the index is trying to reach Uranus targets, the orange lines which provided both Support and Resistance as the index was topping in early 2011. The price levels associated with those lines are 7117 and 7279."

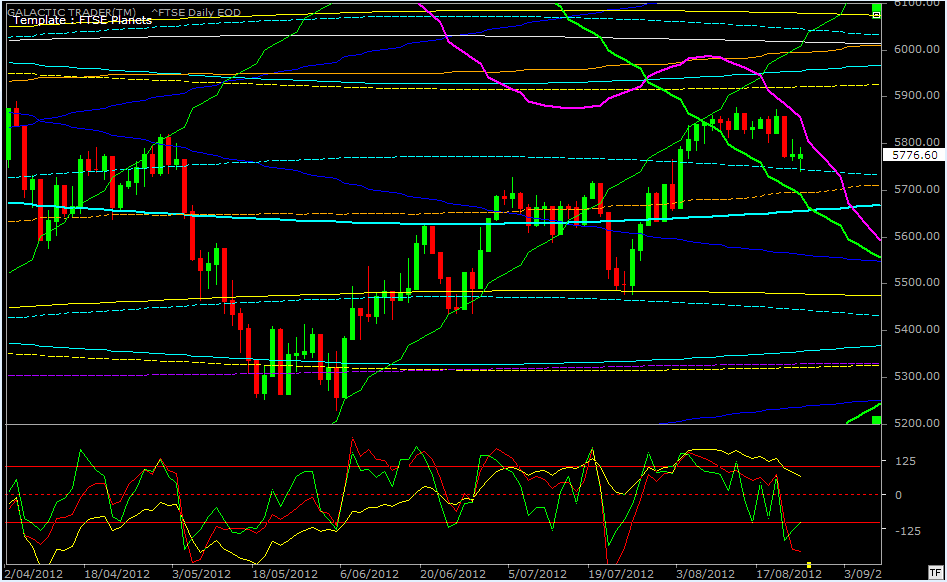

We began last weekend with a FTSE Daily chart, showing the potential for a planetary downdraft to develop.

Close ... but no cigar. The DAX made it only to 7105 before dropping away. Still, it did "try" to reach the Uranus target. As y'can tell, those orange Uranus lines have a bit of history with weekly price moves on this index.

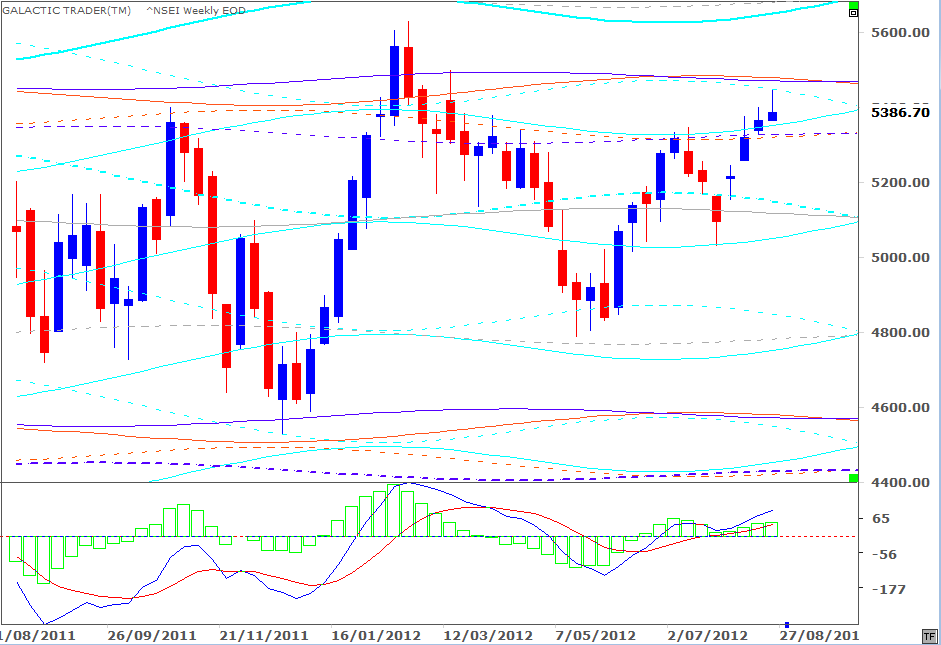

I had thought the Nifty might be aiming for a Pluto barrier at 5473 before its rally faded. Again, we had an effort to get there ... but the rise stalled at the 5448 Saturn level instead.

I had thought the Nifty might be aiming for a Pluto barrier at 5473 before its rally faded. Again, we had an effort to get there ... but the rise stalled at the 5448 Saturn level instead.

I went into some detail last weekend about the probable impact on the FTSE - and, by extension, other indices - and rather than go through it all again, you can check the Archives if you need a refresher.

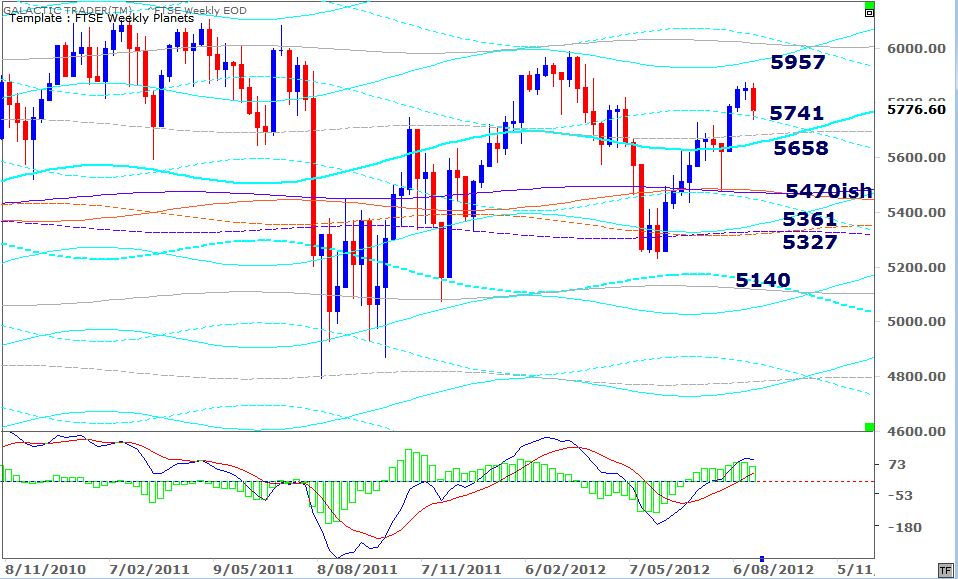

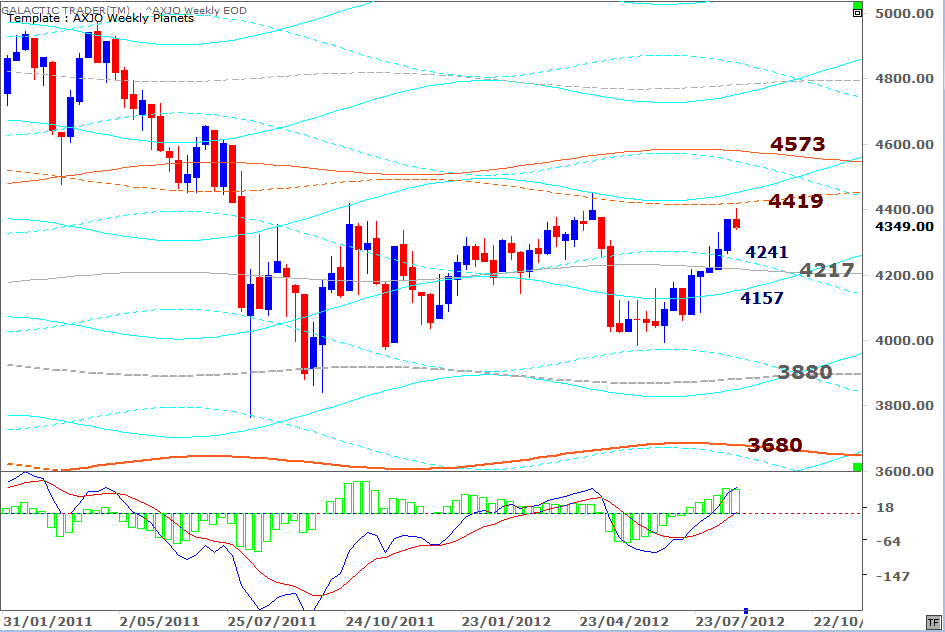

The FTSE's Weekly Planets chart is below, showing target prices if the downturn continues.

The FTSE's Weekly Planets chart is below, showing target prices if the downturn continues.

If you're trading either of those indices (and I know some of you are), you might want to copy and paste those charts for quick reference in the weeks ahead.

The ASX200 Weekly Planets chart is below.

The ASX200 Weekly Planets chart is below.

I often make the point, especially for newbies and small traders who need to keep their costs under control, that Fibonacci Rx and Xt levels, are a perfectly adequate alternative to planetary levels - and we can use the 200 as an example.

Okay. Let's recap. Our preferred oscillators are starting to sing off-key. We have an energy pattern shift with both the Sun and Mars changing signs. We've spent the past few weekends expecting a challenge to earlier Highs, especially with Wall Street, because the technical conditions were over-riding the expectations of further declines caused by the Bradley Model dates and my interpretations of The Spooky Stuff.

Now, we're beginning to see the technical conditions also starting to shift.

Now, we're beginning to see the technical conditions also starting to shift.